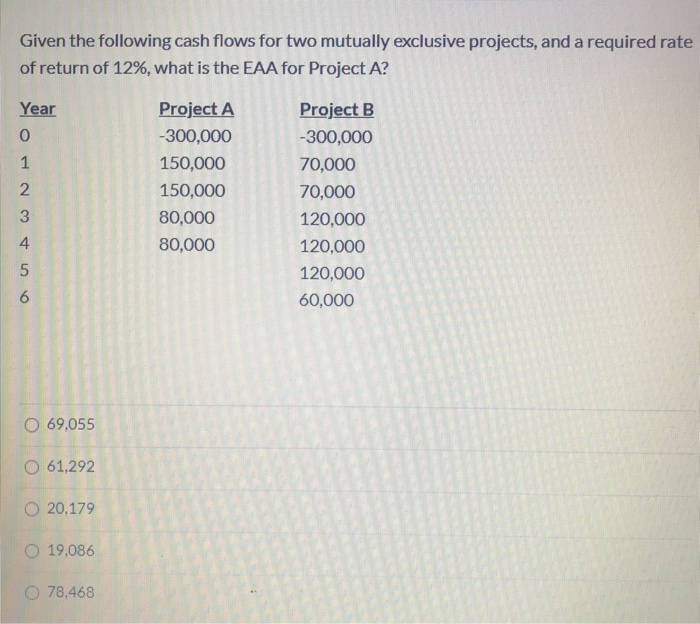

Question: Given the following cash flows for two mutually exclusive projects, and a required rate of return of 12%, what is the EAA for Project A?

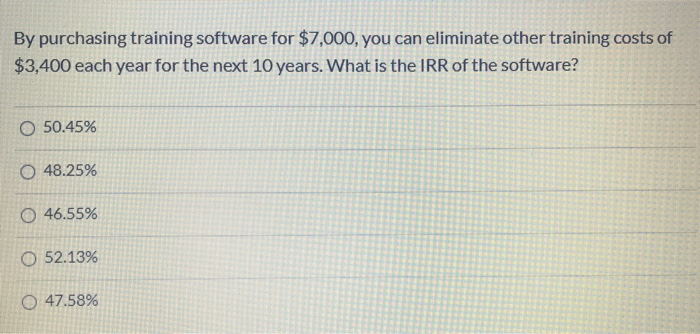

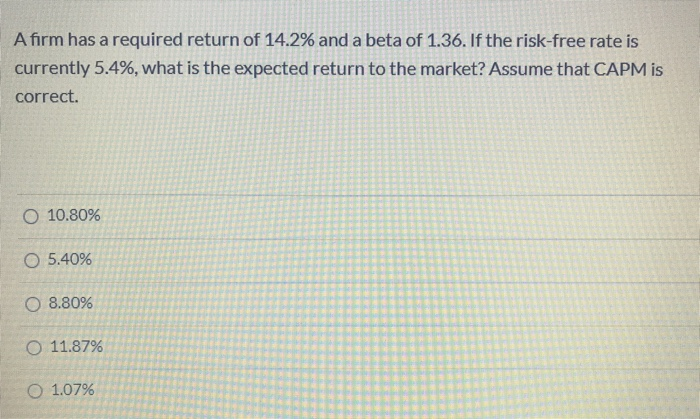

Given the following cash flows for two mutually exclusive projects, and a required rate of return of 12%, what is the EAA for Project A? Year 0 1 Project A -300,000 150,000 150,000 80,000 80,000 2 Project B -300,000 70,000 70,000 120,000 120,000 120,000 60,000 5 6 O 69,055 0 61,292 O 20.179 O 19,086 0 78,468 By purchasing training software for $7,000, you can eliminate other training costs of $3,400 each year for the next 10 years. What is the IRR of the software? O 50.45% 0 48.25% O 46.55% 0 52.13% O 47.58% A firm has a required return of 14.2% and a beta of 1.36. If the risk-free rate is currently 5.4%, what is the expected return to the market? Assume that CAPM is correct. O 10.80% O 5.40% O 8.80% O 11.87% O 1.07%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts