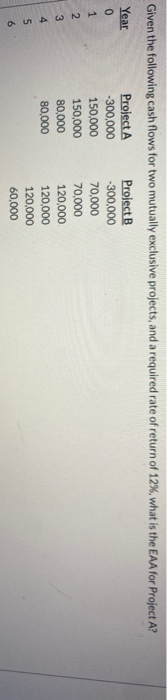

Question: Given the following cash flows for two mutually exclusive projects, and a required rate of return of 12%, what is the EAA for Project A?

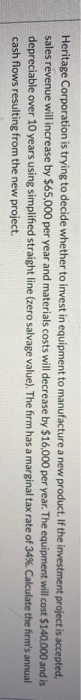

Given the following cash flows for two mutually exclusive projects, and a required rate of return of 12%, what is the EAA for Project A? Year Project A Project B 0 - 300,000 -300,000 1 150,000 70,000 2 150,000 70,000 3 80,000 120,000 4 80,000 120,000 5 120,000 60,000 6 Heritage Corporation is trying to decide whether to invest in equipment to manufacture a new product. If the investment project is accepted, sales revenue will increase by $65,000 per year and materials costs will decrease by $16,000 per year. The equipment will cost $140,000 and is depreciable over 10 years using simplified straight line (zero salvage value). The firm has a marginal tax rate of 34%. Calculate the firm's annual cash flows resulting from the new project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts