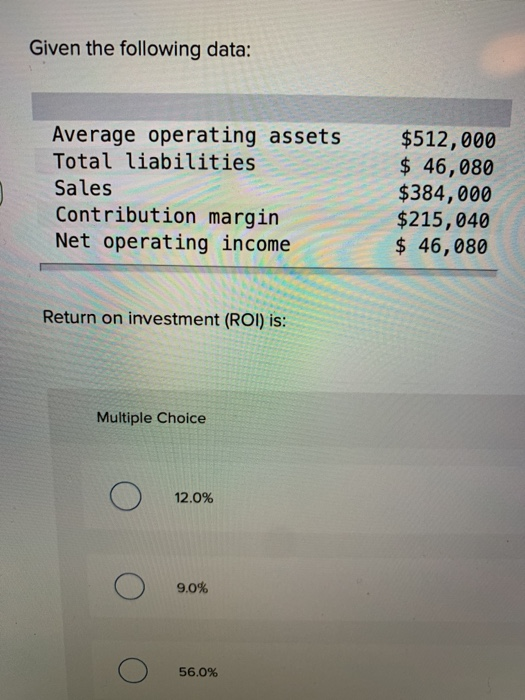

Question: Given the following data: Average operating assets Total liabilities Sales Contribution margin Net operating income $512,000 $ 46,080 $384,000 $215,040 $ 46,080 Return on investment

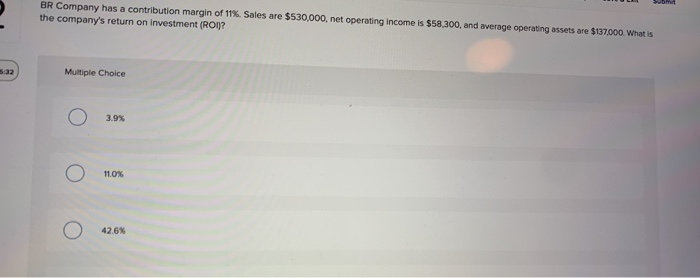

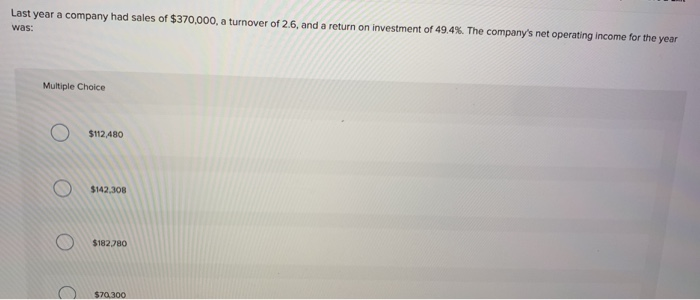

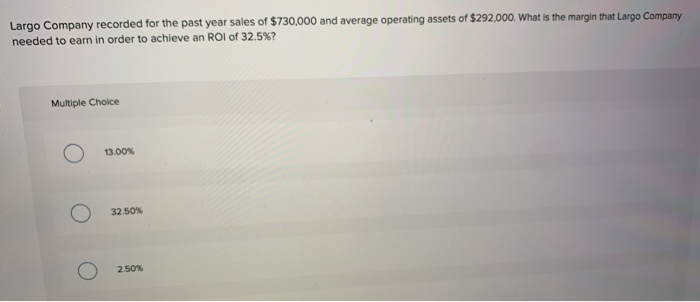

Given the following data: Average operating assets Total liabilities Sales Contribution margin Net operating income $512,000 $ 46,080 $384,000 $215,040 $ 46,080 Return on investment (ROI) is: o 12.0% o 9.0% o 56.0% BR Company has a contribution margin of 11%. Sales are $530,000, net operating Income is $58,300, and average operating assets are $137.000. What is the company's return on investment (ROI? Multiple Choice Last year a company had sales of $370,000, a turnover of 2.6, and a return on investment of 49.4%. The company's net operating income for the year was: Multiple Choice 3142, si Largo Company recorded for the past year sales of $730,000 and average operating assets of $292,000. What is the margin that Largo Company needed to earn in order to achieve an ROI of 32.5%? Multiple Choice . 32.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts