Question: Given the following data, calculate the net present value for this capital budgeting project: Annual operating cash flow = $198,500 Fixed asset investment = $649,000

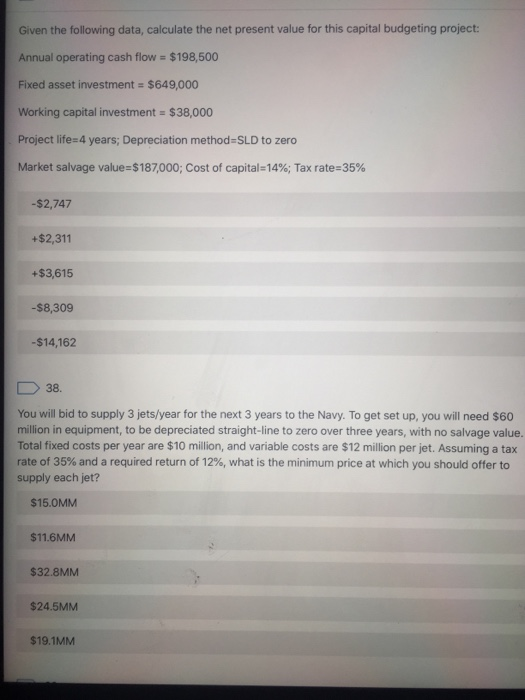

Given the following data, calculate the net present value for this capital budgeting project: Annual operating cash flow = $198,500 Fixed asset investment = $649,000 Working capital investment = $38,000 Project life=4 years; Depreciation method=SLD to zero Market salvage value=$187,000; Cost of capital=14%; Tax rate=35% -$2,747 +$2,311 +$3,615 -$8,309 -$14,162 38. You will bid to supply 3 jets/year for the next 3 years to the Navy. To get set up, you will need $60 million in equipment, to be depreciated straight-line to zero over three years, with no salvage value. Total fixed costs per year are $10 million, and variable costs are $12 million per jet. Assuming a tax rate of 35% and a required return of 12%, what is the minimum price at which you should offer to supply each jet? $15.0MM $11.6MM $32.8MM $24.5MM $19.1MM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts