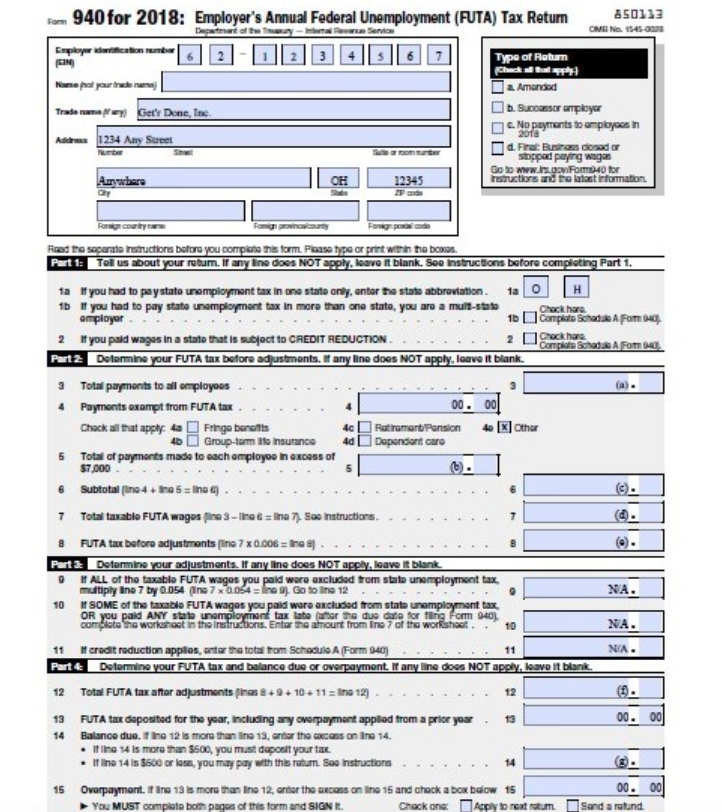

Question: Given the following data, complete Form 940 for Get'r Done, Inc., for the 2018 year: Total wages paid for the year were $165,250 Total wages

Given the following data, complete Form 940 for Get'r Done, Inc., for the 2018 year: Total wages paid for the year were $165,250 Total wages subject to FUTA Tax are $57,500:

940 for 2018: Employer's Annual Federal Unemployment (FUTA) Tax Return ECTOSP Employer 6 2 -1 2 3 4 5 6 7 Typo of Roturn & Amandod Get'r Done, Inc. &. No payments to a ployoes In Addrun 1234 Am Sucel 2018 d. Fret: Bupinions doand or Stopped paying wigs Amwhere OH 12345 Faced the separate Ireductions before you complete this form. Please type or print within the boxes. Part 1: Tell us about your return. If any line does NOT apply, leave it blank. Son Instructions before completing Part 1. 1a If you had to pay state unemployment tax in one state only, enter the stats abbreviation O H fb If you had to pay state unemployment tax in more than one state, you are a mult-$19 Pockhan amplayor 1b Complain Schad is A Fom Day 2 If you paid wages in a state that is subject to CREDIT REDUCTION. Part 2: Determine your FUTA tax before adjustments. If any line does NOT apply, leave it blank Total payments to all employous Payments oxompt from FUTA tax 00 . DO Check all that apply: 4a Fringe bongifts Rat iramant/Pension 45 x] Other 40 Group-term life Insurance d Dependent care 5 Total of payments made to each amployos in excess of $7.000 . 6 Subtotal [ing 4 + Ina 5 = [no ) 7 Total taxable FUTA wages fine 3 -ling & = Ina 7). Soo Instructions. d. FUTA tax before adjustments fine 7 x 0.006 = Ing g) Part 3: Determine your adjustments. If any line does NOT apply, leave it blank IT ALL of the taxable FUTA wages you paid were ancluded from state unemployment tax multiply Ino 7 by 0.054 (Ing 7 x = Ing g). Go to Ine 12 NA. 10 I SOME of the taxable FUTA wages you paid were occluded from state unemployment tax, OR you paid ANY state unemployment tax late (after the due date for fling Form 940). complete the works nost In the Instructions. Enter the amount from Ine 7 of the workshoot . 10 NA. 11 If credit reduction apples, 11 NIA . Part 4: Determine your FUTA tax and balance due or over payment. If any line does NOT apply, leave it blank 12 Total FUTA tax aftor adjustments finos 8+ 9 + 10 + 11 =[n9 12) . 13 FUTA tax deposited for the year, Including any overpayment applied from a prior your 00 . 00 Balance due. If Ing 12 Is more than Iine 13, enter the excess on Its 14. . It line 14 Is more than $600, you must depcell your tax. If line 14 is $500 or less, you may pay with this return Soo Instructions 15 Overpaymont. If Ing 13 is more than Ine 12, enter the ations on line 15 and chuck a box below 15 00 . 00 YOU MUST complain both pages mand SIGN E. Chock one Apply to read istum. Sand a rotund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts