Question: Given the following data: Treasury Bill Bid Asked Maturity Mar DTM 90 1.35 1.25 Stock XYZ is currently trading at $175 per share. You spot

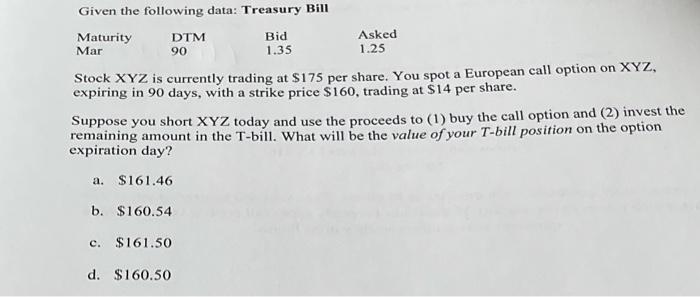

Given the following data: Treasury Bill Bid Asked Maturity Mar DTM 90 1.35 1.25 Stock XYZ is currently trading at $175 per share. You spot a European call option on XYZ, expiring in 90 days, with a strike price $160, trading at $14 per share. Suppose you short XYZ today and use the proceeds to (1) buy the call option and (2) invest the remaining amount in the T-bill. What will be the value of your T-bill position on the option expiration day? a. $161.46 b. $160.54 c. $161.50 d. $160.50

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock