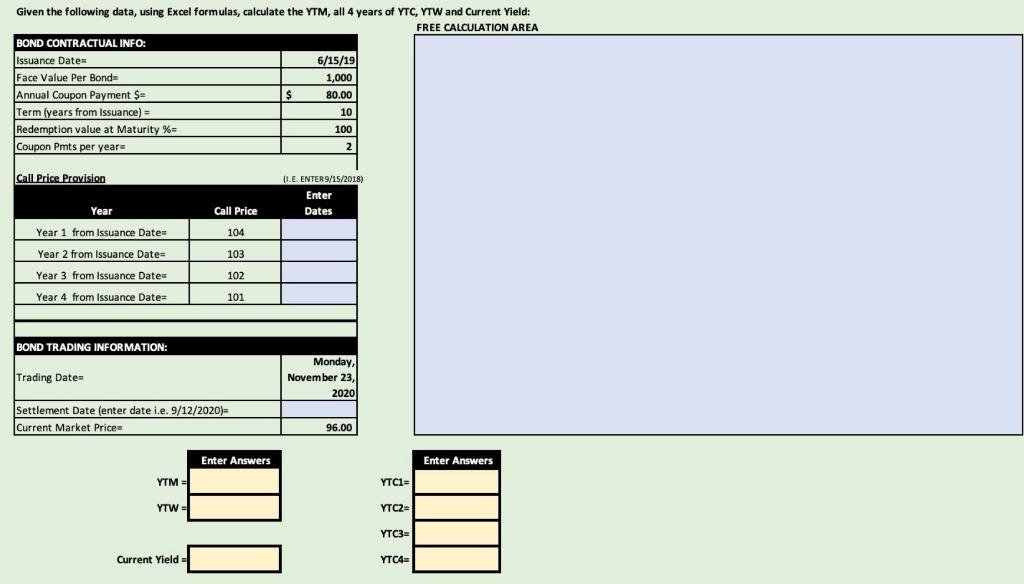

Question: Given the following data, using Excel formulas, calculate the YTM, all 4 years of YTC, YTW and Current Yield: FREE CALCULATION AREA BOND CONTRACTUAL INFO:

Given the following data, using Excel formulas, calculate the YTM, all 4 years of YTC, YTW and Current Yield: FREE CALCULATION AREA BOND CONTRACTUAL INFO: : Issuance Date 6/15/19 Face Value Per Bonde 1,000 Annual Coupon Payment S- $ 80.00 Term (years from Issuance) = 10 Redemption value at Maturity %= 100 Coupon Pmts per year= 2 Call Price Provision I.E. ENTER 9/15/2018) Enter Dates Call Price 104 Year Year 1 from Issuance Dates Year 2 from Issuance Date= 2 Year 3 from Issuance Dates 103 102 Year 4 from Issuance Date= 101 BOND TRADING INFORMATION: Monday, Trading Date= November 23, , 2020 Settlement Date (enter date i.e. 9/12/2020)= = Current Market Price 96.00 Enter Answers Enter Answers YTM= YTC1= YTW = YTC2- YTC3- Current Yield YTC4= Given the following data, using Excel formulas, calculate the YTM, all 4 years of YTC, YTW and Current Yield: FREE CALCULATION AREA BOND CONTRACTUAL INFO: : Issuance Date 6/15/19 Face Value Per Bonde 1,000 Annual Coupon Payment S- $ 80.00 Term (years from Issuance) = 10 Redemption value at Maturity %= 100 Coupon Pmts per year= 2 Call Price Provision I.E. ENTER 9/15/2018) Enter Dates Call Price 104 Year Year 1 from Issuance Dates Year 2 from Issuance Date= 2 Year 3 from Issuance Dates 103 102 Year 4 from Issuance Date= 101 BOND TRADING INFORMATION: Monday, Trading Date= November 23, , 2020 Settlement Date (enter date i.e. 9/12/2020)= = Current Market Price 96.00 Enter Answers Enter Answers YTM= YTC1= YTW = YTC2- YTC3- Current Yield YTC4=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts