Question: Given the following: Define the Break Even Point (BEP) in months for the DMAIC Project as identified below. The current cost of living adjustment is

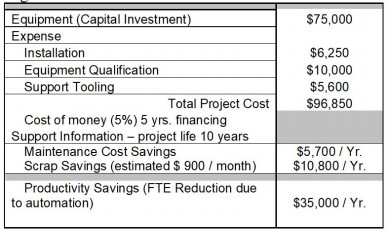

Given the following: Define the Break Even Point (BEP) in months for the DMAIC Project as identified below. The current cost of living adjustment is 3% that should be applied for future savings (hint future saving should be discounted when calculating PV savings), expenses are included as part of the total project cost, savings are stated annually with no annual increase factor applied, project time horizon is 10 years, the cost of money (5%) is the current interest being charged to finance the project.

Question A) Calculate the negative cash flow including interest payments? Question B). Calculate the average annual positive cash flow? Question C) Calculate the Break Even Point in months? Question D) Calculate the Return on Investment (using the 10 year time horizon)?

Question A) Calculate the negative cash flow including interest payments? Question B). Calculate the average annual positive cash flow? Question C) Calculate the Break Even Point in months? Question D) Calculate the Return on Investment (using the 10 year time horizon)?

Equipment (Capital Investment) Expense $75,000 $6,250 $10,000 $5,600 Total Project Cost $96,850 Installation Equipment Qualification Support Tooling Cost of money (5%) 5 yrs. financing Support Information-project life 10 years $5,700 Yr $10,800/Yr Maintenance Cost Savings Scrap Savings (estimated $ 900 month Productivity Savings (FTE Reduction due $35,000 Yr to automation) Equipment (Capital Investment) Expense $75,000 $6,250 $10,000 $5,600 Total Project Cost $96,850 Installation Equipment Qualification Support Tooling Cost of money (5%) 5 yrs. financing Support Information-project life 10 years $5,700 Yr $10,800/Yr Maintenance Cost Savings Scrap Savings (estimated $ 900 month Productivity Savings (FTE Reduction due $35,000 Yr to automation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts