Question: Given the following expected cash flow stream, determine the NPV of the proposed investment in an income producing property and determine whether or not the

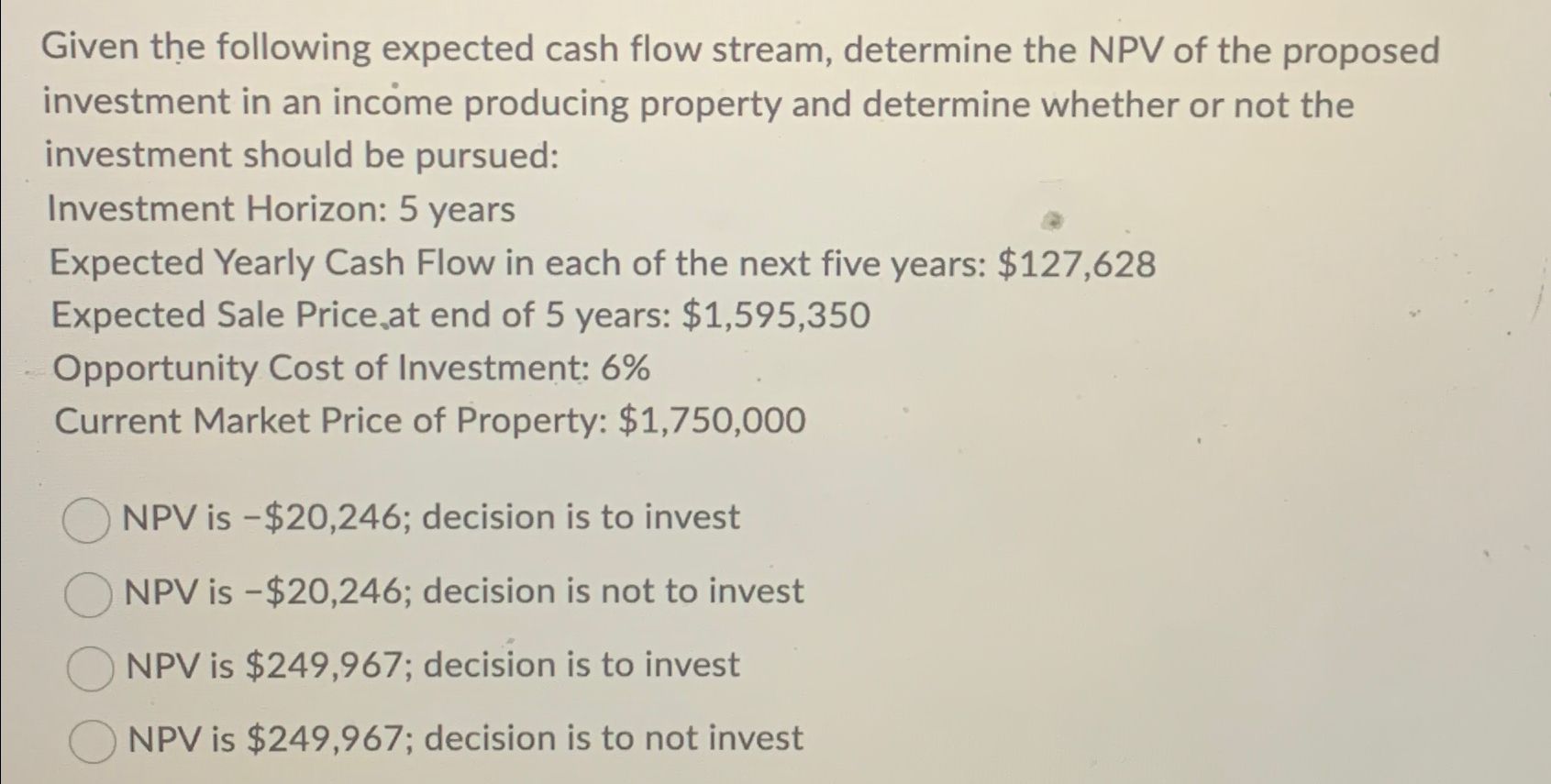

Given the following expected cash flow stream, determine the NPV of the proposed investment in an income producing property and determine whether or not the investment should be pursued:

Investment Horizon: years

Expected Yearly Cash Flow in each of the next five years: $

Expected Sale Price, at end of years: $

Opportunity Cost of Investment:

Current Market Price of Property: $

NPV is $; decision is to invest

NPV is $; decision is not to invest

NPV is $; decision is to invest

NPV is $; decision is to not invest

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock