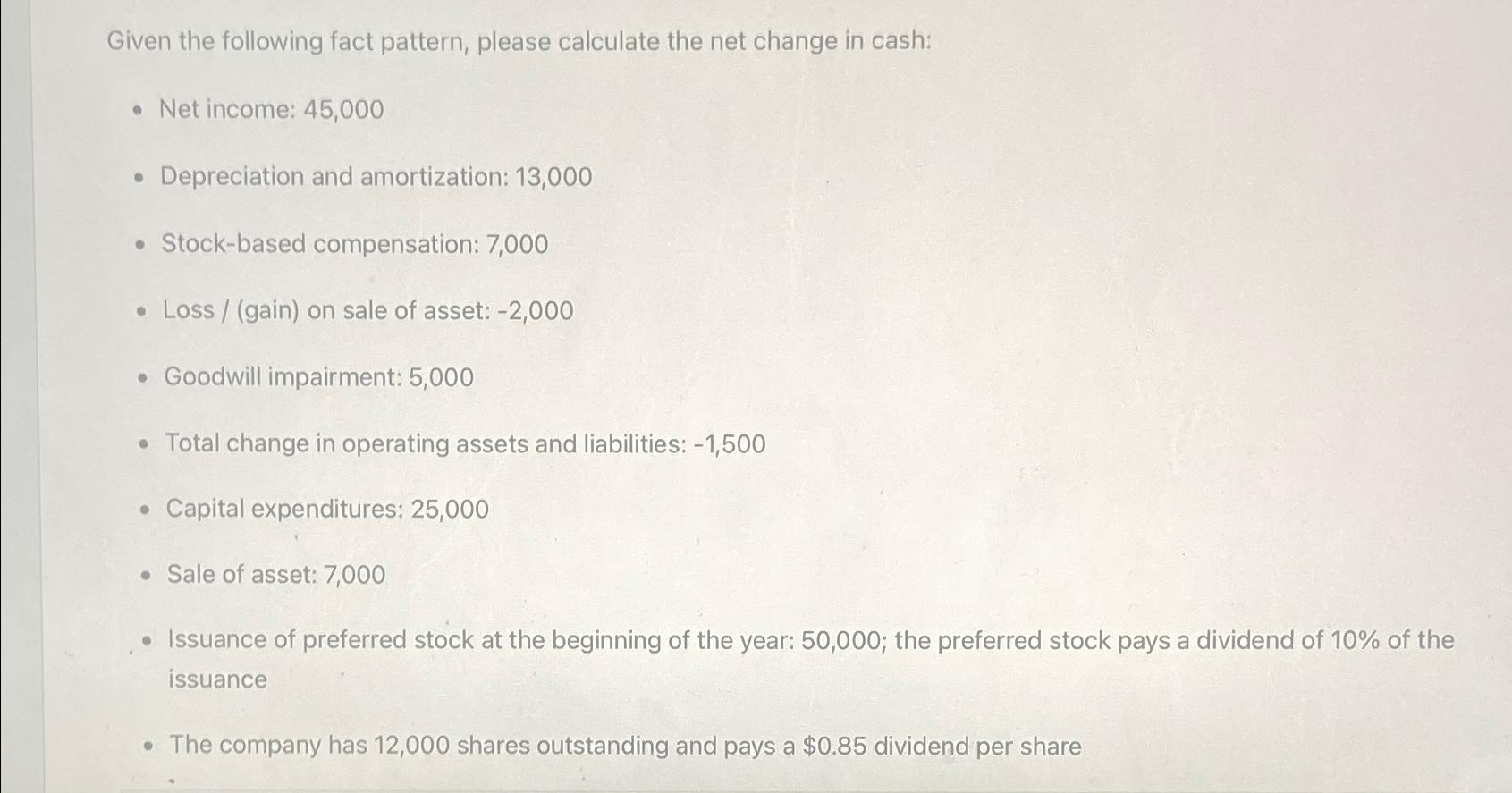

Question: Given the following fact pattern, please calculate the net change in cash: Net income: 45,000 Depreciation and amortization: 13,000 Stock-based compensation: 7,000 Loss / (gain)

Given the following fact pattern, please calculate the net change in cash:\ Net income: 45,000\ Depreciation and amortization: 13,000\ Stock-based compensation: 7,000\ Loss / (gain) on sale of asset:

-2,000\ Goodwill impairment: 5,000\ Total change in operating assets and liabilities:

-1,500\ Capital expenditures: 25,000\ Sale of asset: 7,000\ Issuance of preferred stock at the beginning of the year: 50,000 ; the preferred stock pays a dividend of

10%of the issuance\ The company has 12,000 shares outstanding and pays a

$0.85dividend per share

Given the following fact pattern, please calculate the net change in cash: - Net income: 45,000 - Depreciation and amortization: 13,000 - Stock-based compensation: 7,000 - Loss / (gain) on sale of asset: 2,000 - Goodwill impairment: 5,000 - Total change in operating assets and liabilities: 1,500 - Capital expenditures: 25,000 - Sale of asset: 7,000 - Issuance of preferred stock at the beginning of the year: 50,000 ; the preferred stock pays a dividend of 10% of the issuance - The company has 12,000 shares outstanding and pays a $0.85 dividend per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts