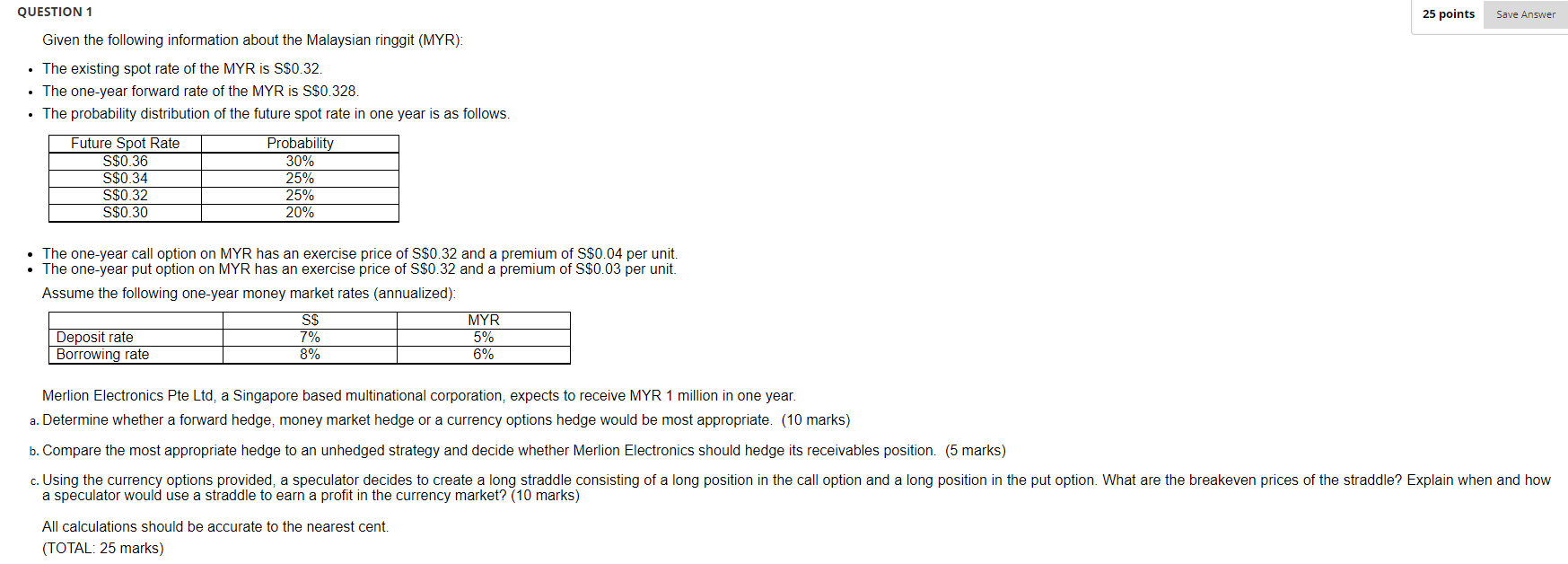

Question: Given the following information about the Malaysian ringgit (MYR): - The existing spot rate of the MYR is $0.32. - The one-year forward rate of

Given the following information about the Malaysian ringgit (MYR): - The existing spot rate of the MYR is $0.32. - The one-year forward rate of the MYR is $0.328. - The probability distribution of the future spot rate in one year is as follows. - The one-year call option on MYR has an exercise price of S$0.32 and a premium of $0.04 per unit. - The one-year put option on MYR has an exercise price of S$0.32 and a premium of S$0.03 per unit. Assume the following one-year money market rates (annualized): Merlion Electronics Pte Ltd, a Singapore based multinational corporation, expects to receive MYR 1 million in one year. a. Determine whether a forward hedge, money market hedge or a currency options hedge would be most appropriate. (10 marks) b. Compare the most appropriate hedge to an unhedged strategy and decide whether Merlion Electronics should hedge its receivables position. (5 marks) a speculator would use a straddle to earn a profit in the currency market? (10 marks) All calculations should be accurate to the nearest cent. (TOTAL: 25 marks) Given the following information about the Malaysian ringgit (MYR): - The existing spot rate of the MYR is $0.32. - The one-year forward rate of the MYR is $0.328. - The probability distribution of the future spot rate in one year is as follows. - The one-year call option on MYR has an exercise price of S$0.32 and a premium of $0.04 per unit. - The one-year put option on MYR has an exercise price of S$0.32 and a premium of S$0.03 per unit. Assume the following one-year money market rates (annualized): Merlion Electronics Pte Ltd, a Singapore based multinational corporation, expects to receive MYR 1 million in one year. a. Determine whether a forward hedge, money market hedge or a currency options hedge would be most appropriate. (10 marks) b. Compare the most appropriate hedge to an unhedged strategy and decide whether Merlion Electronics should hedge its receivables position. (5 marks) a speculator would use a straddle to earn a profit in the currency market? (10 marks) All calculations should be accurate to the nearest cent. (TOTAL: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts