Question: Given the following information, compute the taxable value for the particular piece of property in dollar terms: Market value of property: $ 5 1 5

Given the following information, compute the taxable value for the particular piece of

property in dollar terms:

Market value of property: $

Assessed value of property: of the market value of the property

Exemptions: $

Taxes paid: $

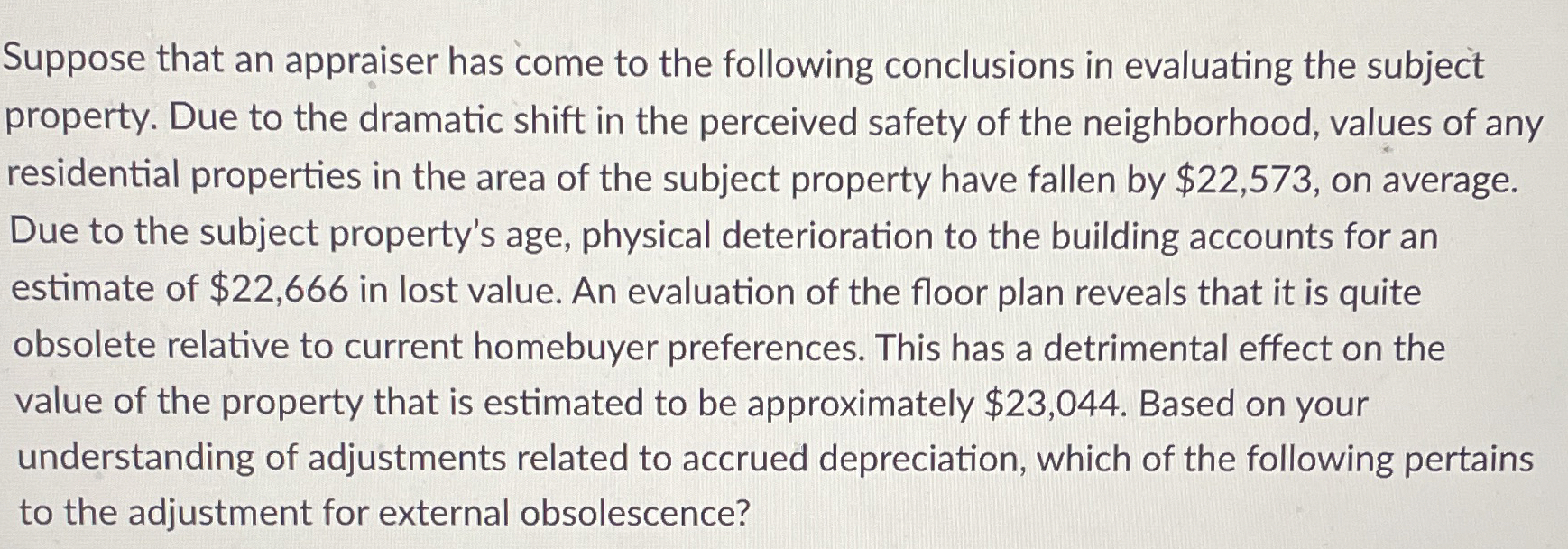

Suppose that an appraiser has come to the following conclusions in evaluating the subject

property. Due to the dramatic shift in the perceived safety of the neighborhood, values of any

residential properties in the area of the subject property have fallen by $ on average.

Due to the subject property's age, physical deterioration to the building accounts for an

estimate of $ in lost value. An evaluation of the floor plan reveals that it is quite

obsolete relative to current homebuyer preferences. This has a detrimental effect on the

value of the property that is estimated to be approximately $ Based on your

understanding of adjustments related to accrued depreciation, which of the following pertains

to the adjustment for external obsolescence?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock