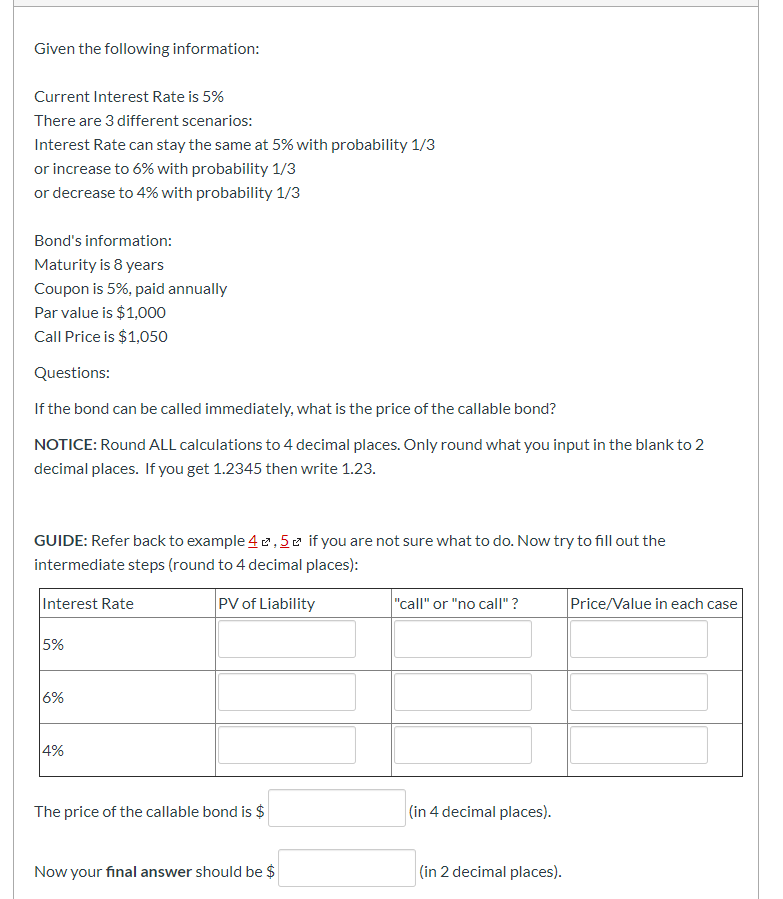

Question: Given the following information: Current Interest Rate is 5% There are 3 different scenarios: Interest Rate can stay the same at 5% with probability 1/3

Given the following information: Current Interest Rate is 5% There are 3 different scenarios: Interest Rate can stay the same at 5% with probability 1/3 or increase to 6% with probability 1/3 or decrease to 4% with probability 1/3 Bond's information: Maturity is 8 years Coupon is 5%, paid annually Par value is $1,000 Call Price is $1,050 Questions: If the bond can be called immediately, what is the price of the callable bond? NOTICE: Round ALL calculations to 4 decimal places. Only round what you input in the blank to 2 decimal places. If you get 1.2345 then write 1.23. GUIDE: Refer back to example 4 2,5if you are not sure what to do. Now try to fill out the intermediate steps (round to 4 decimal places): Interest Rate PV of Liability "call" or "no call"? Price/Value in each case 5% 6% 4% The price of the callable bond is $ (in 4 decimal places). Now your final answer should be $ (in 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts