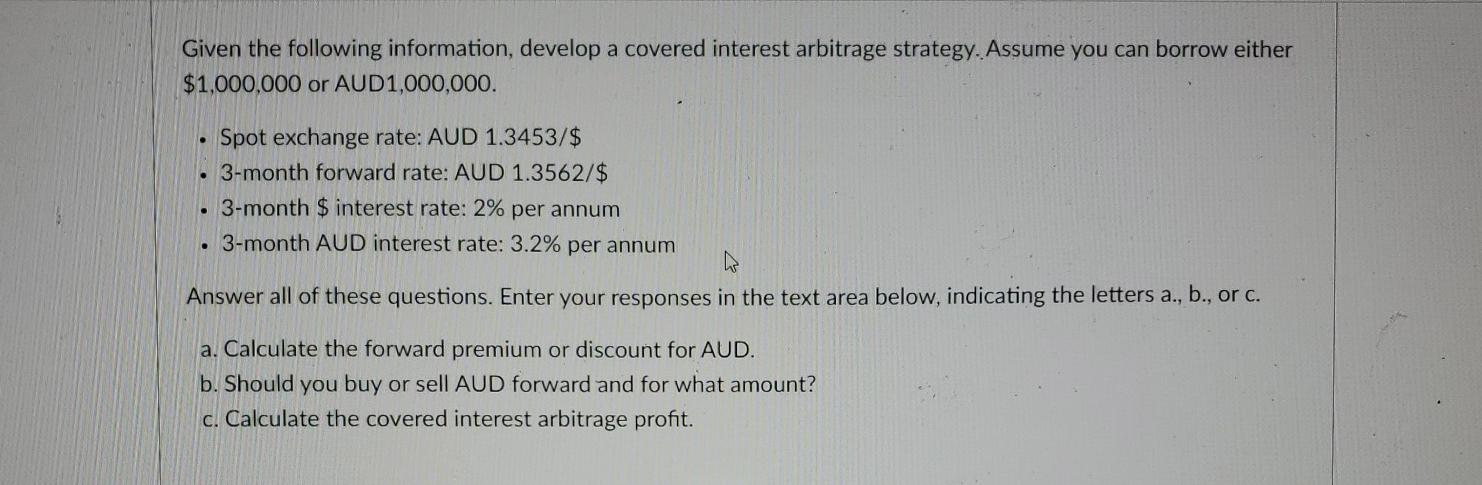

Question: Given the following information, develop a covered interest arbitrage strategy. Assume you can borrow either $1,000,000 or AUD1,000,000. . . Spot exchange rate: AUD 1.3453/$

Given the following information, develop a covered interest arbitrage strategy. Assume you can borrow either $1,000,000 or AUD1,000,000. . . Spot exchange rate: AUD 1.3453/$ 3-month forward rate: AUD 1.3562/$ . 3-month $ interest rate: 2% per annum . 3-month AUD interest rate: 3.2% per annum Answer all of these questions. Enter your responses in the text area below, indicating the letters a., b., or C. a. Calculate the forward premium or discount for AUD. b. Should you buy or sell AUD forward and for what amount? c. Calculate the covered interest arbitrage profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts