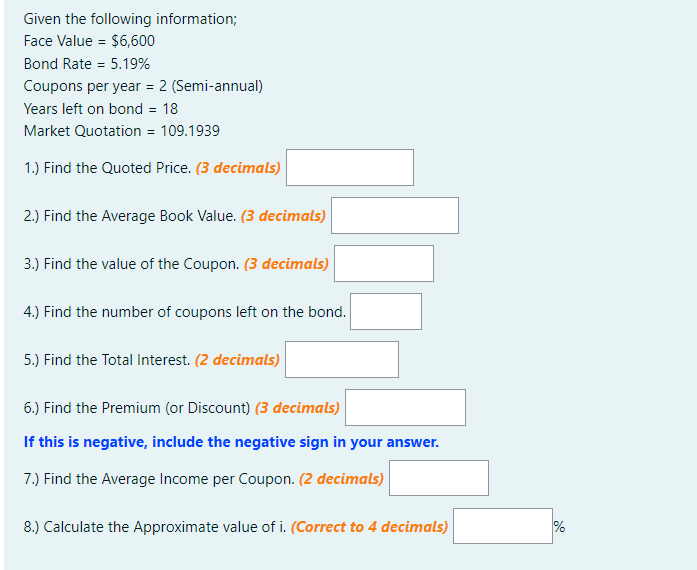

Question: Given the following information; Face Value = $6,600 Bond Rate = 5.19% Coupons per year = 2 (Semi-annual) Years left on bond = 18 Market

Given the following information; Face Value = $6,600 Bond Rate = 5.19% Coupons per year = 2 (Semi-annual) Years left on bond = 18 Market Quotation = 109.1939 1.) Find the Quoted Price. (3 decimals) 2.) Find the Average Book Value. (3 decimals) 3.) Find the value of the Coupon. (3 decimals) 4.) Find the number of coupons left on the bond. 5.) Find the Total Interest. (2 decimals) 6.) Find the Premium (or Discount) (3 decimals) If this is negative, include the negative sign in your answer. 7.) Find the Average Income per Coupon. (2 decimals) 8.) Calculate the Approximate value of i. (Correct to 4 decimals) % Given the following information; Face Value = $6,600 Bond Rate = 5.19% Coupons per year = 2 (Semi-annual) Years left on bond = 18 Market Quotation = 109.1939 1.) Find the Quoted Price. (3 decimals) 2.) Find the Average Book Value. (3 decimals) 3.) Find the value of the Coupon. (3 decimals) 4.) Find the number of coupons left on the bond. 5.) Find the Total Interest. (2 decimals) 6.) Find the Premium (or Discount) (3 decimals) If this is negative, include the negative sign in your answer. 7.) Find the Average Income per Coupon. (2 decimals) 8.) Calculate the Approximate value of i. (Correct to 4 decimals) %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts