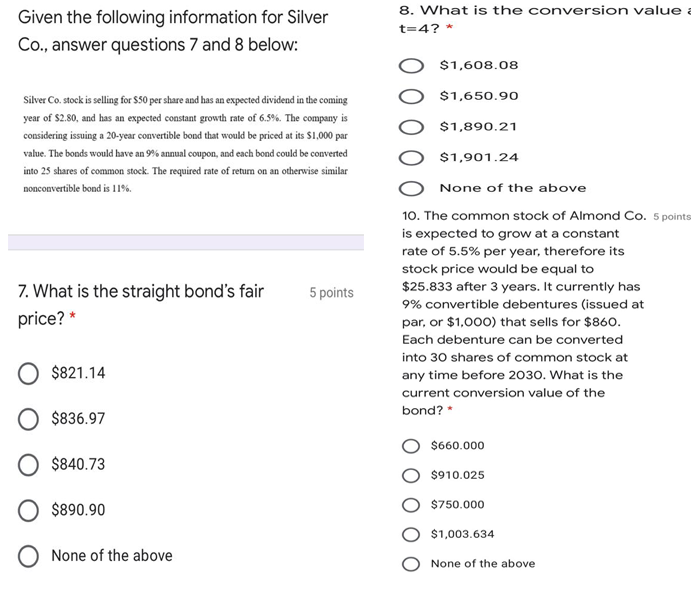

Question: Given the following information for Silver Co., answer questions 7 and 8 below: 8. What is the conversion value t=4?* $1,608.08 $1,650.90 $1,890.21 Silver Co.

Given the following information for Silver Co., answer questions 7 and 8 below: 8. What is the conversion value t=4?* $1,608.08 $1,650.90 $1,890.21 Silver Co. stock is selling for $50 per share and has an expected dividend in the coming year of $2.80, and has an expected constant growth rate of 6.5%. The company is considering issuing a 20-year convertible bond that would be priced at its $1,000 par value. The bonds would have an 9% annual coupon, and each bond could be converted into 25 shares of common stock. The required rate of retum on an otherwise similar nonconvertible bond is 11% 5 points 7. What is the straight bond's fair price? * $1,901.24 None of the above 10. The common stock of Almond Co. 5 points is expected to grow at a constant rate of 5.5% per year, therefore its stock price would be equal to $25.833 after 3 years. It currently has 9% convertible debentures (issued at par, or $1.000) that sells for $860. Each debenture can be converted into 30 shares of common stock at any time before 2030. What is the current conversion value of the bond? $821.14 O $836.97 $660.000 O $840.73 $910.025 O $890.90 $750.000 $1,003.634 None of the above None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts