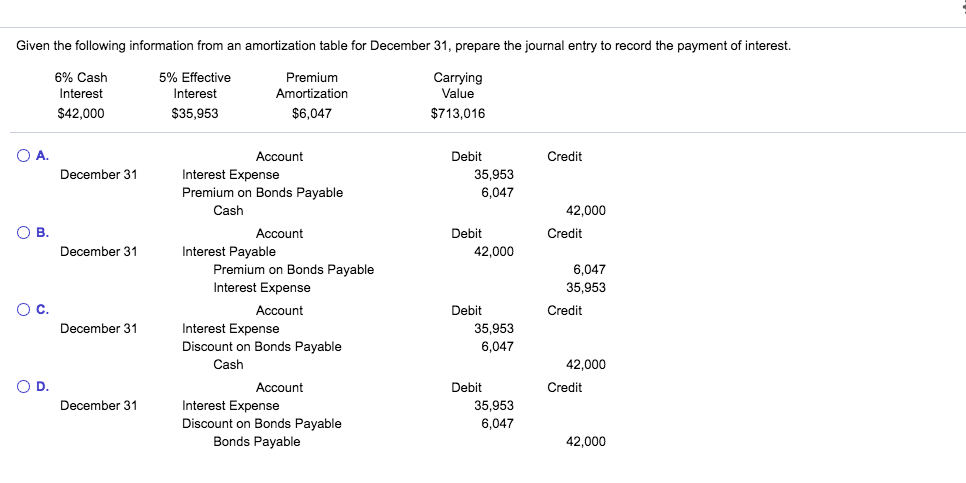

Question: Given the following information from an amortization table for December 31, prepare the journal entry to record the payment of interest. 6% Cash Interest $42,000

Given the following information from an amortization table for December 31, prepare the journal entry to record the payment of interest. 6% Cash Interest $42,000 5% Effective Interest $35,953 Carrying Value $713,016 Premiumm Amortization $6,047 O A. Account Debit Credit 35,953 6,047 December 31 Interest Expense Prem ium on Bonds Payable Cash 42,000 Account Debit Credit December 31 Interest Payable 42,000 Premium on Bonds Payable Interest Expense 6,047 35,953 Account Debit Credit 35,953 6,047 December 31 Interest Expense Discount on Bonds Payable Cash 42,000 Account Debit Credit 35,953 6,047 December 31 Interest Expense Discount on Bonds Payable Bonds Payable 42,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts