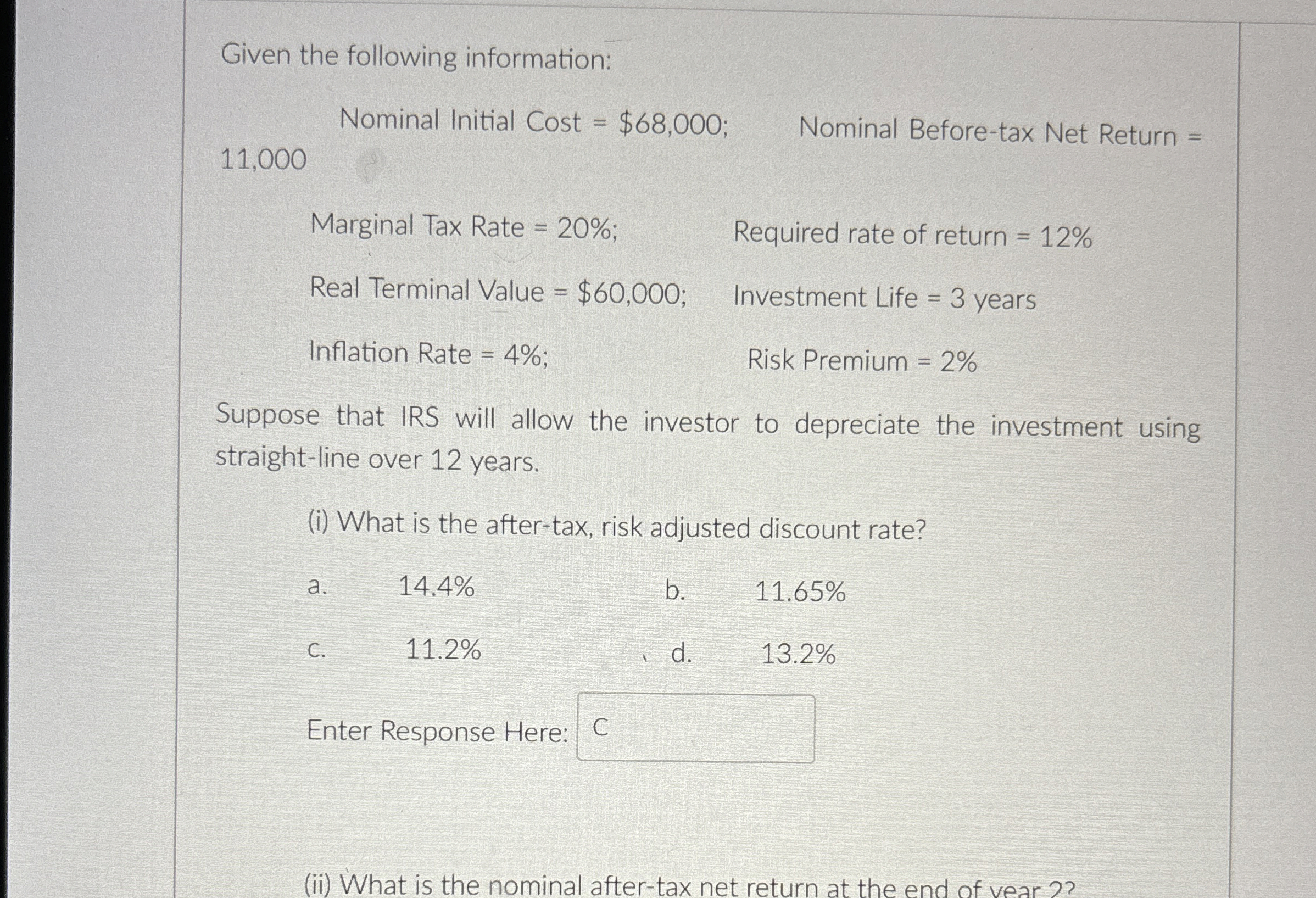

Question: Given the following information: Nominal Initial Cost = $ 6 8 , 0 0 0 ; Nominal Before - tax Net Return = 1 1

Given the following information:

Nominal Initial Cost $;

Nominal Beforetax Net Return

Marginal Tax Rate ; Required rate return

Real Terminal Value $; Investment Life years

Inflation Rate ; Risk Premium

Suppose that IRS will allow the investor to depreciate the investment using straightline over years.

i What is the aftertax, risk adjusted discount rate?

a

b

c

d

Enter Response Here:

ii What is the nominal aftertax net return at the end of vear

What is the nominal after tax terminal value?

What is the present value of the nominal after tax terminal value?

What is the NPV of this investment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock