Question: Given the following information: PART ONE Average Returns, Variance and Standard Deviation of the stocks. Analyze these values for each firm Compare these values

Given the following information:

PART ONE

- Average Returns, Variance and Standard Deviation of the stocks.

- Analyze these values for each firm

- Compare these values between firms

- Beta

- Compare and contrast these Beta estimates

- What is the difference between the two types of measures?

- How do these ideas contribute to the valuation of the firm?

PART TWO

- Give an answer as to whether or not you should buy these stocks and explain why. Please be detailed and refer back to previous information.

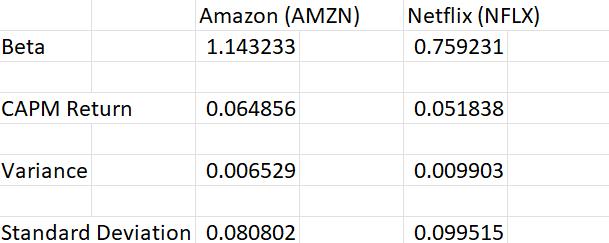

Beta CAPM Return Variance Amazon (AMZN) 1.143233 0.064856 0.006529 Standard Deviation 0.080802 Netflix (NFLX) 0.759231 0.051838 0.009903 0.099515

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

PART ONE Average Returns Variance and Standard Deviation of the stocks For Amazon AMZN Average Return Not provided in the given information Variance 0006529 Standard Deviation 0080802 For Netflix NFLX ... View full answer

Get step-by-step solutions from verified subject matter experts