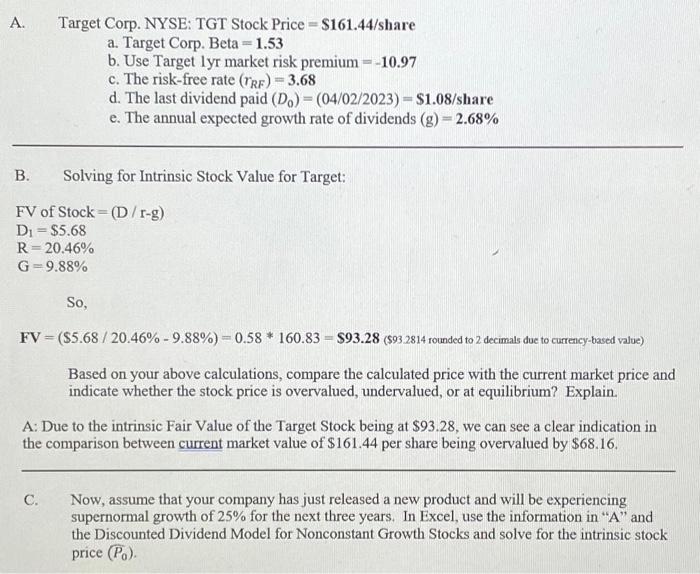

Question: given the following information: Please solve for 'C.' only for upvote Target Corp. NYSE: TGT Stock Price =$161.44/ share a. Target Corp. B Beta =1.53

Target Corp. NYSE: TGT Stock Price =$161.44/ share a. Target Corp. B Beta =1.53 b. Use Target lyr market risk premium =10.97 c. The risk-free rate (rRF)=3.68 e. The annual expected growth rate of dividends (g)=2.68% B. Solving for Intrinsic Stock Value for Target: FVofStock=(D/rg)D1=$5.68R=20.46%G=9.88% So, FV=($5.68/20.46%9.88%)=0.58160.83=$93.28($93.2814roundedto2decimalsduetocurrency-basedvalue) Based on your above calculations, compare the calculated price with the current market price and indicate whether the stock price is overvalued, undervalued, or at equilibrium? Explain. A: Due to the intrinsic Fair Value of the Target Stock being at $93.28, we can see a clear indication in the comparison between current market value of $161.44 per share being overvalued by $68.16. C. Now, assume that your company has just released a new product and will be experiencing supernormal growth of 25% for the next three years. In Excel, use the information in " A " and the Discounted Dividend Model for Nonconstant Growth Stocks and solve for the intrinsic stock price (P0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts