Question: Given the following information, what is the expected return and standard deviation on a portfolio that is invested 30 percent in both Stocks A and

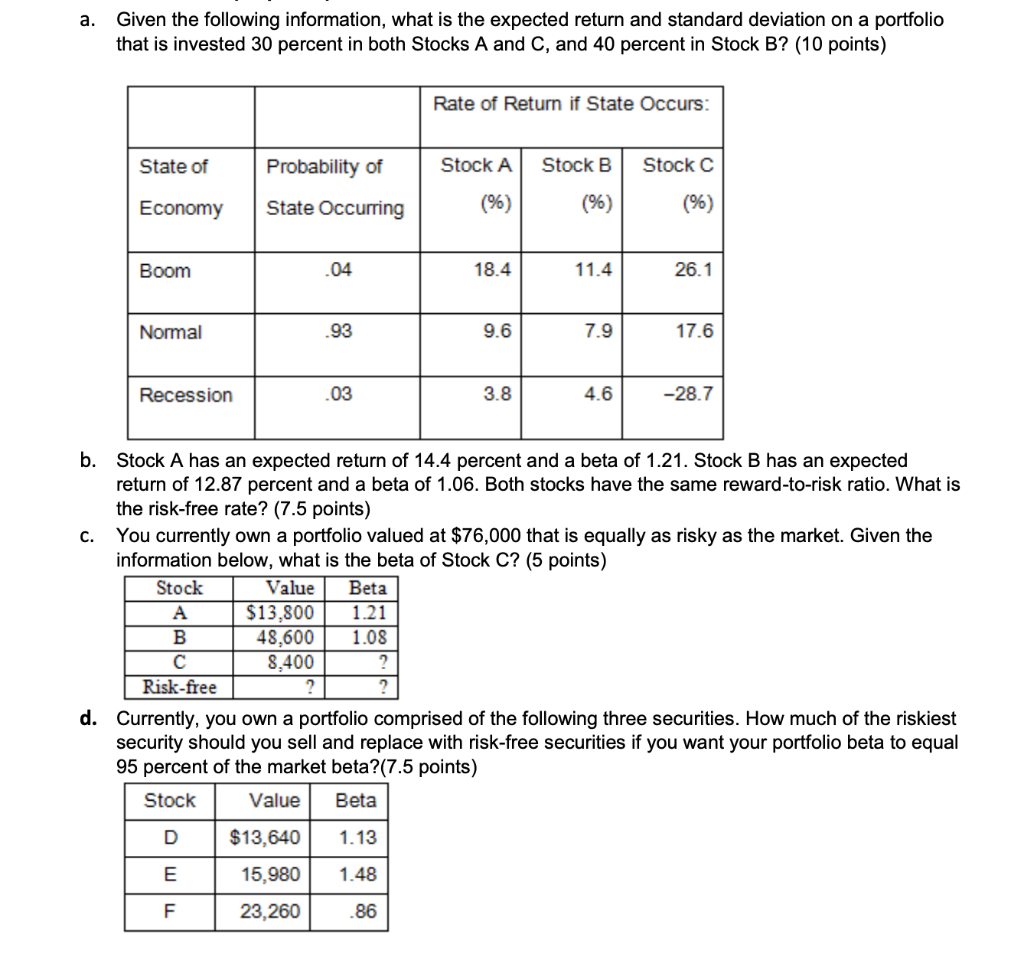

Given the following information, what is the expected return and standard deviation on a portfolio that is invested 30 percent in both Stocks A and C, and 40 percent in Stock B? (10 points) a Rate of Return if State Occurs: Stock A Probability of Stock B Stock C State of (%) (%) (%) State Occurring Economy 04 18.4 11.4 26.1 Boom 93 9.6 7.9 17.6 Normal 03 3.8 4.6 -28.7 Recession b. Stock A has an expected return of 14.4 return of 12.87 percent and a beta of 1.06. Both stocks have the same reward-to-risk ratio. What is the risk-free rate? (7.5 points) You currently own a portfolio valued at $76,000 that is equally as risky as the market. Given the information below, what is the beta of Stock C? (5 points) and a beta of 1.21. Stock B has an expected C. Value Stock Beta $13,800 48,600 8.400 1.21 1.08 C Risk-free d. Currently, you own a portfolio comprised of the following three securities. How much of the riskiest security should you sell and replace with risk-free securities if you want your portfolio beta to equal 95 percent of the market beta?(7.5 points) Stock Value Beta $13,640 D 1.13 E 15,980 1.48 23,260 .86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts