Question: Given the following is a probability distribution for returns on a security A, and a proxy for the market, M: State 1 2 3

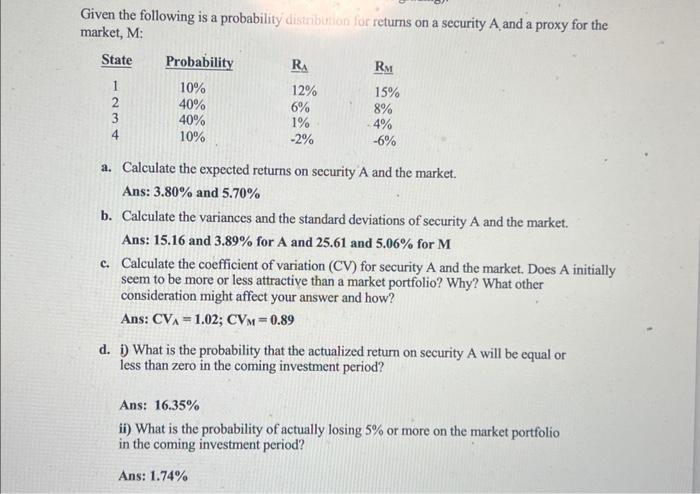

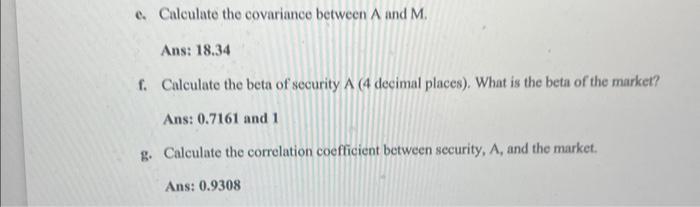

Given the following is a probability distribution for returns on a security A, and a proxy for the market, M: State 1 2 3 4 Probability 10% 40% 40% 10% RA 12% 6% 1% -2% RM 15% 8% 4% -6% a. Calculate the expected returns on security A and the market. Ans: 3.80% and 5.70% b. Calculate the variances and the standard deviations of security A and the market. Ans: 15.16 and 3.89% for A and 25.61 and 5.06% for M c. Calculate the coefficient of variation (CV) for security A and the market. Does A initially seem to be more or less attractive than a market portfolio? Why? What other consideration might affect your answer and how? Ans: CVA 1.02; CVM = 0.89 d. i) What is the probability that the actualized return on security A will be equal or less than zero in the coming investment period? Ans: 16.35% ii) What is the probability of actually losing 5% or more on the market portfolio in the coming investment period? Ans: 1.74% e. Calculate the covariance between A and M. Ans: 18.34 f. Calculate the beta of security A (4 decimal places). What is the beta of the market? Ans: 0.7161 and 1 g. Calculate the correlation coefficient between security, A, and the market. Ans: 0.9308

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Lets go step by step to calculate each part a Expected returns on security A and the market ERA 0100... View full answer

Get step-by-step solutions from verified subject matter experts