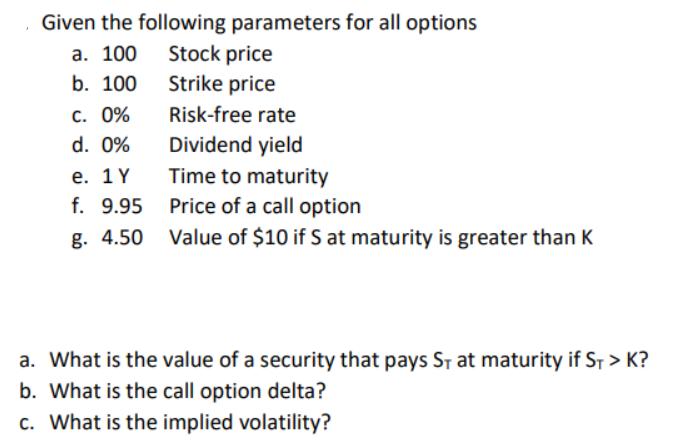

Question: Given the following parameters for all options a. 100 b. 100 c. 0% d. 0% e. 1 Y f. 9.95 g. 4.50 Stock price

Given the following parameters for all options a. 100 b. 100 c. 0% d. 0% e. 1 Y f. 9.95 g. 4.50 Stock price Strike price Risk-free rate Dividend yield Time to maturity Price of a call option Value of $10 if S at maturity is greater than K a. What is the value of a security that pays S, at maturity if ST > K? b. What is the call option delta? C. What is the implied volatility?

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

a The value of a security that pays S at maturity if ST K is equal to the difference between the sto... View full answer

Get step-by-step solutions from verified subject matter experts