Question: Given the following parameters on a Future Brent Contract on crude oil, F oil = 45, X= $44, t= , and rf = 5%, find

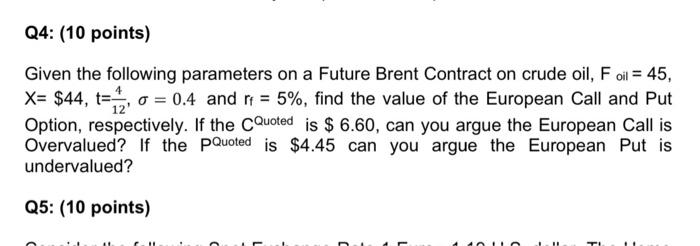

Q4: (10 points) Given the following parameters on a Future Brent Contract on crude oil, F oil = 45, X= $44, t=7,0 = 0.4 and rf = 5%, find the value of the European Call and Put Option, respectively. If the CQuoted is $ 6.60, can you argue the European Call is Overvalued? If the pQuoted is $4.45 can you argue the European Put is undervalued? Q5: (10 points) 1 n T L Q4: (10 points) Given the following parameters on a Future Brent Contract on crude oil, F oil = 45, X= $44, t=7,0 = 0.4 and rf = 5%, find the value of the European Call and Put Option, respectively. If the CQuoted is $ 6.60, can you argue the European Call is Overvalued? If the pQuoted is $4.45 can you argue the European Put is undervalued? Q5: (10 points) 1 n T L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts