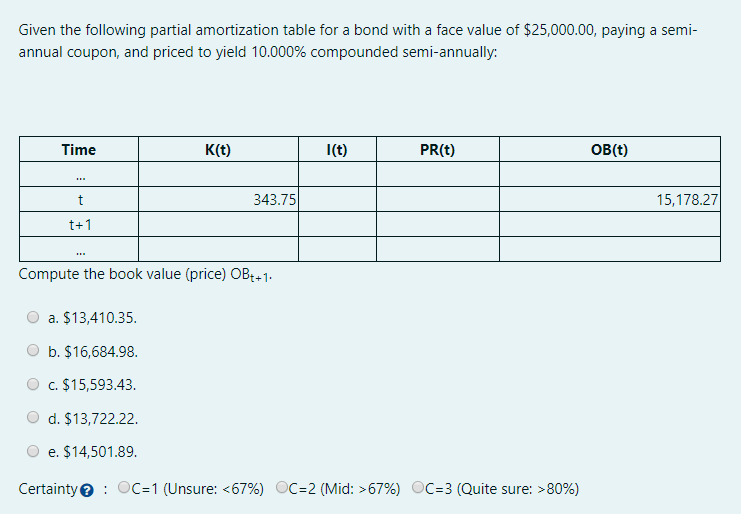

Question: Given the following partial amortization table for a bond with a face value of $25,000.00, paying a semi- annual coupon, and priced to yield 10.000%

Given the following partial amortization table for a bond with a face value of $25,000.00, paying a semi- annual coupon, and priced to yield 10.000% compounded semi-annually: Time k(t) I(t) PR(t) OB(t) t 343.75 15,178.27 t+1 Compute the book value (price) OBt+1. a. $13,410.35. b. $16,684.98. C. $15,593.43 d. $13,722.22. e. $14,501.89. Certainty : C=1 (Unsure: 67%) OC=3 (Quite sure: >80%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts