Question: given the following please answer the following. please create a Bank reconciliation for the company. like the following says Feb. 26: Replenished the petty cash

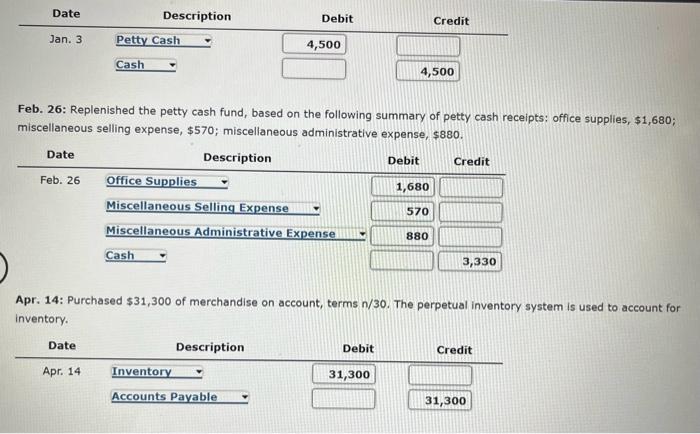

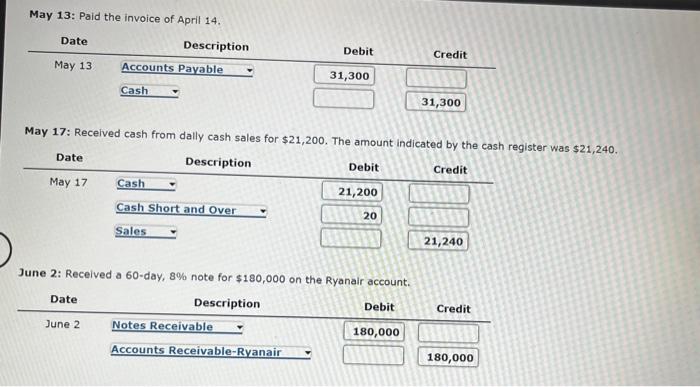

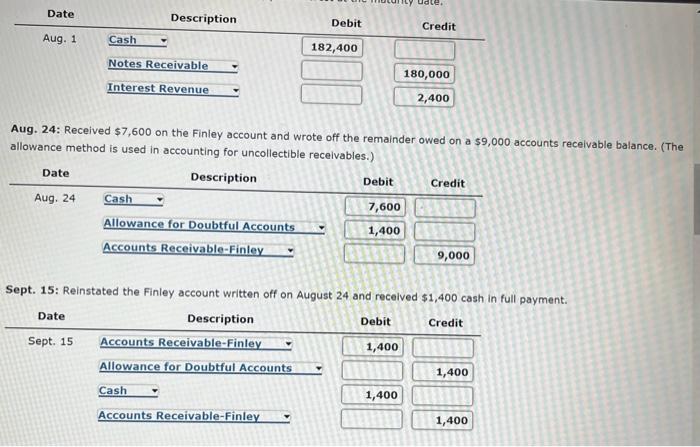

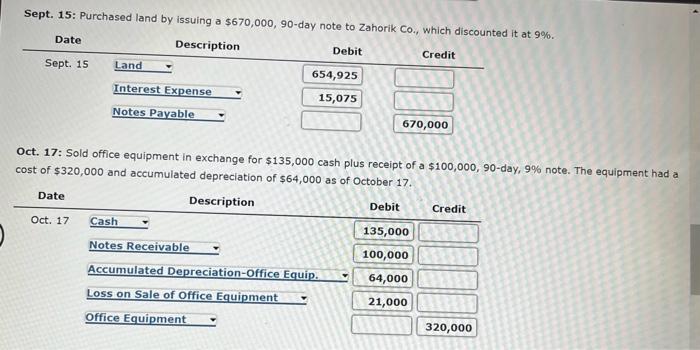

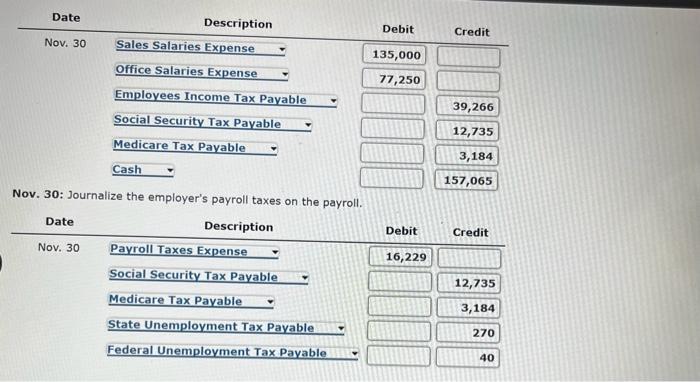

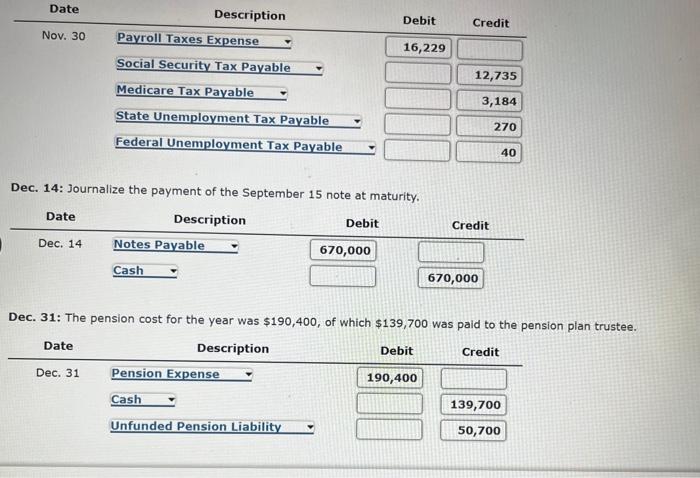

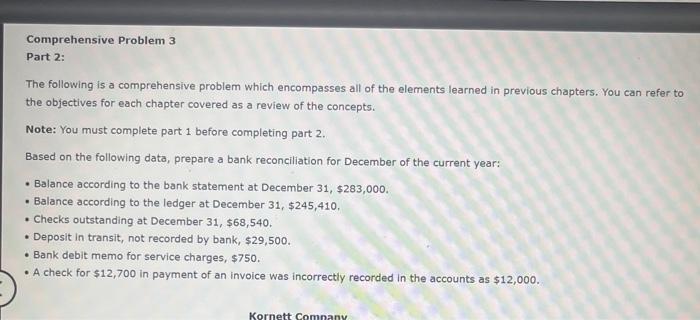

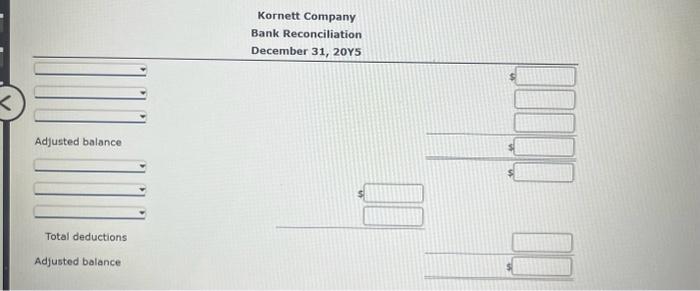

Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1,680; miscellaneous selling expense, $570; miscellaneous administrative expense, $880. Apr. 14: Purchased $31,300 of merchandise on account, terms n/30. The perpetual inventory system is used to account for inventory. May 13: Paid the invoice of April 14. May 17: Recelved cash from dally cash sales for $21,200. The amount indicated by the cash register was $21,240. June 2: Received a 60 -day, 8% note for $180,000 on the Ryanair account. Aug. 24: Received $7,600 on the Finley account and wrote off the remainder owed on a $9,000 accounts receivable balance. (The allowance method is used in accounting for uncollectible receivables.) Sept. 15: Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment. Sept. 15: Purchased land by issuing a $670,000,90-day note to Zahorik Co.. which fiemaintad it at 9%. Oct. 17: Sold office equipment in exchange for $135,000 cash plus receipt of a $100,000,90-day, 9% note. The equipment had a cost of $320,000 and accumulated depreciation of $64,000 as of October 17. ivuv. su: journailze the employer's payroll taxes on the payroll. Dec. 14: Journalize the payment of the September 15 note at maturity. Dec. 31: The pension cost for the year was $190,400, of which $139,700 was paid to the pension plan trustee. Comprehensive Problem 3 Part 2: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note: You must complete part 1 before completing part 2. Based on the following data, prepare a bank reconciliation for December of the current year: - Balance according to the bank statement at December 31,$283,000. - Balance according to the ledger at December 31,$245,410, - Checks outstanding at December 31,$68,540. - Deposit in transit, not recorded by bank, $29,500. - Bank debit memo for service charges, $750. - A check for $12,700 in payment of an invoice was incorrectly recorded in the accounts as $12,000. Kornett Company Bank Reconciliation December 31,20 Y Adjusted balance Total deductions Adjusted balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts