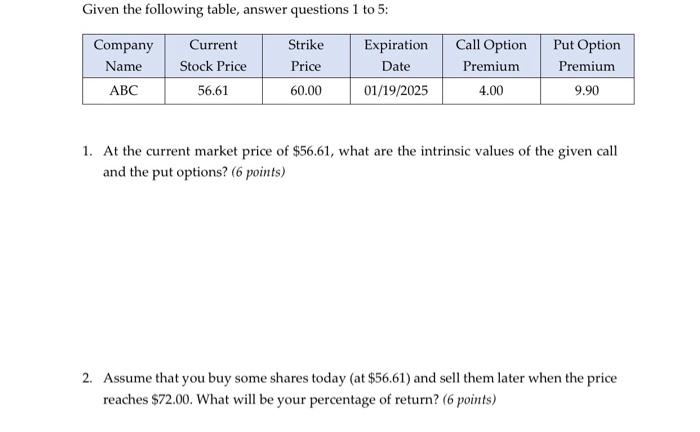

Question: Given the following table, answer questions 1 to 5 : 1. At the current market price of $56.61, what are the intrinsic values of the

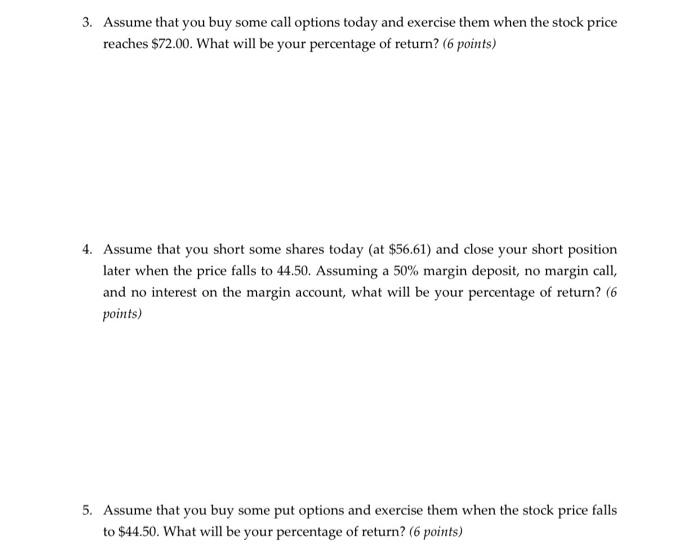

Given the following table, answer questions 1 to 5 : 1. At the current market price of $56.61, what are the intrinsic values of the given call and the put options? ( 6 points) 2. Assume that you buy some shares today (at $56.61 ) and sell them later when the price reaches $72.00. What will be your percentage of return? (6 points) 3. Assume that you buy some call options today and exercise them when the stock price reaches $72.00. What will be your percentage of return? (6 points) 4. Assume that you short some shares today (at $56.61 ) and close your short position later when the price falls to 44.50 . Assuming a 50% margin deposit, no margin call, and no interest on the margin account, what will be your percentage of return? ( 6 points) 5. Assume that you buy some put options and exercise them when the stock price falls to $44.50. What will be your percentage of return? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts