Question: Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax

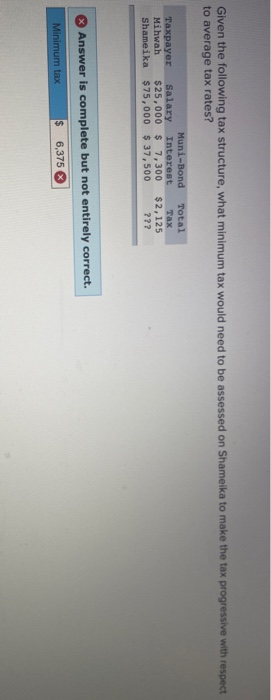

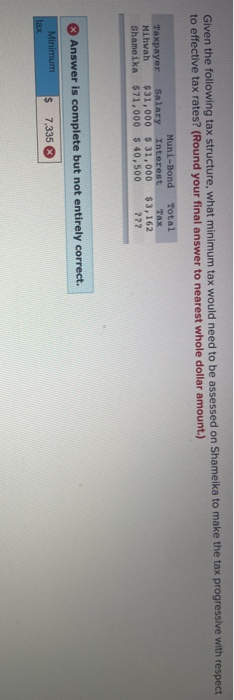

Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax rates? Taxpayer Mihwah Shameika Muni-Bond Salary Interest $25,000 $ 7,300 $75,000 $ 37,500 Total Tax $2,125 ??? Answer is complete but not entirely correct. Minimum tax $ 6,375 Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to effective tax rates? (Round your final answer to nearest whole dollar amount.) Total Tax Muni-Bond Taxpayer Salary Interest Mihwah $31,000 $ 31,000 Shameika $71,000 $ 40,500 $3,162 222 Answer is complete but not entirely correct. Minimum tax s 7,335

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts