Question: Given the following three assets, determine whether an arbitrage opportunity exists according to the arbitrage pricing theory. If so, please calculate the excess return of

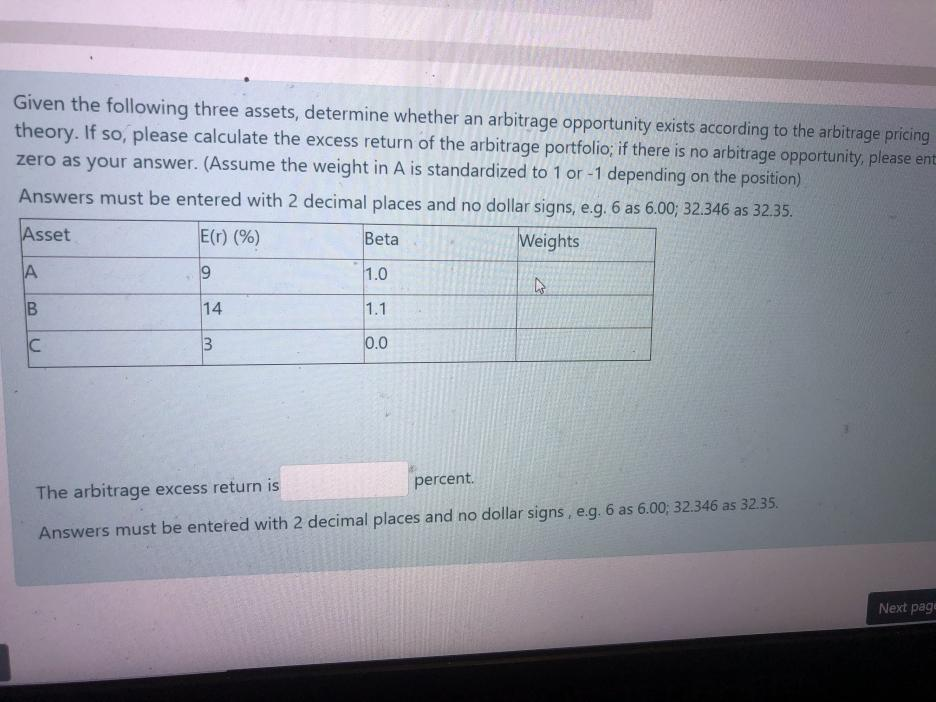

Given the following three assets, determine whether an arbitrage opportunity exists according to the arbitrage pricing theory. If so, please calculate the excess return of the arbitrage portfolio; if there is no arbitrage opportunity, please enter zero as your answer. (Assume the weight in A is standardized to 1 or -1 depending on the position)

Given the following three assets, determine whether an arbitrage opportunity exists according to the arbitrage pricing theory. If so, please calculate the excess return of the arbitrage portfolio; if there is no arbitrage opportunity, please ent zero as your answer. (Assume the weight in A is standardized to 1 or -1 depending on the position) Answers must be entered with 2 decimal places and no dollar signs, e.g. 6 as 6.00; 32.346 as 32.35. Asset E() (%) Beta Weights A 9 1.0 B 14 1.1 IC 3 0.0 percent The arbitrage excess return is Answers must be entered with 2 decimal places and no dollar signs, e.g. 6 as 6.00; 32.346 as 32.35. Next page Given the following three assets, determine whether an arbitrage opportunity exists according to the arbitrage pricing theory. If so, please calculate the excess return of the arbitrage portfolio; if there is no arbitrage opportunity, please ent zero as your answer. (Assume the weight in A is standardized to 1 or -1 depending on the position) Answers must be entered with 2 decimal places and no dollar signs, e.g. 6 as 6.00; 32.346 as 32.35. Asset E() (%) Beta Weights A 9 1.0 B 14 1.1 IC 3 0.0 percent The arbitrage excess return is Answers must be entered with 2 decimal places and no dollar signs, e.g. 6 as 6.00; 32.346 as 32.35. Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts