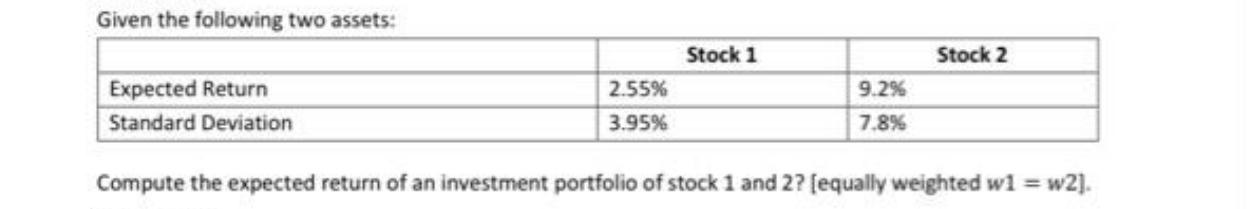

Question: Given the following two assets: Expected Return Standard Deviation 2.55% 3.95% Stock 1 9.2% 7.8% Stock 2 Compute the expected return of an investment

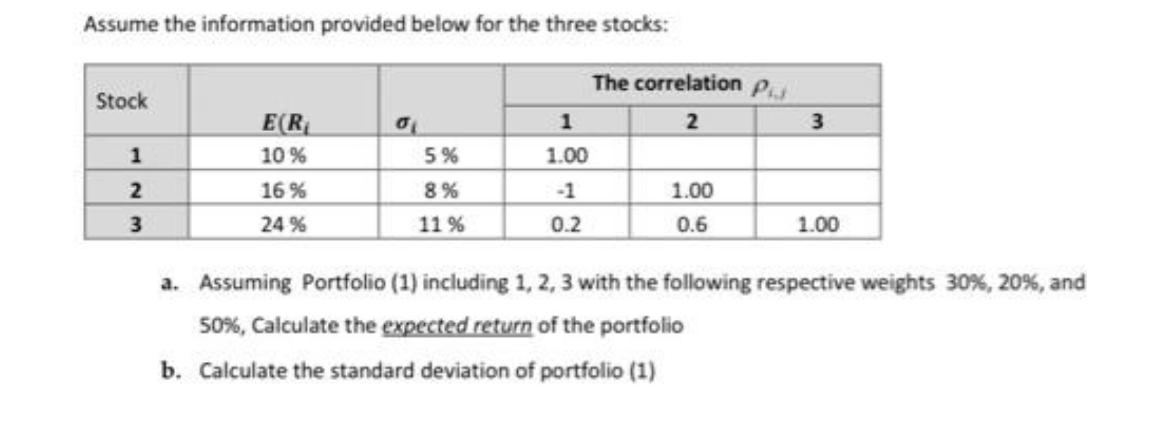

Given the following two assets: Expected Return Standard Deviation 2.55% 3.95% Stock 1 9.2% 7.8% Stock 2 Compute the expected return of an investment portfolio of stock 1 and 2? [equally weighted w1 = w2]. Assume the information provided below for the three stocks: Stock 1 2 3 E(R 10% 16% 24% o 5% 8% 11% 1 1.00 0.2 The correlation P 2 1.00 0.6 3 1.00 a. Assuming Portfolio (1) including 1, 2, 3 with the following respective weights 30%, 20%, and 50%, Calculate the expected return of the portfolio b. Calculate the standard deviation of portfolio (1)

Step by Step Solution

There are 3 Steps involved in it

a To calculate the expected return of Portfolio 1 with weights of 30 for Stock 1 20 for Stock 2 a... View full answer

Get step-by-step solutions from verified subject matter experts