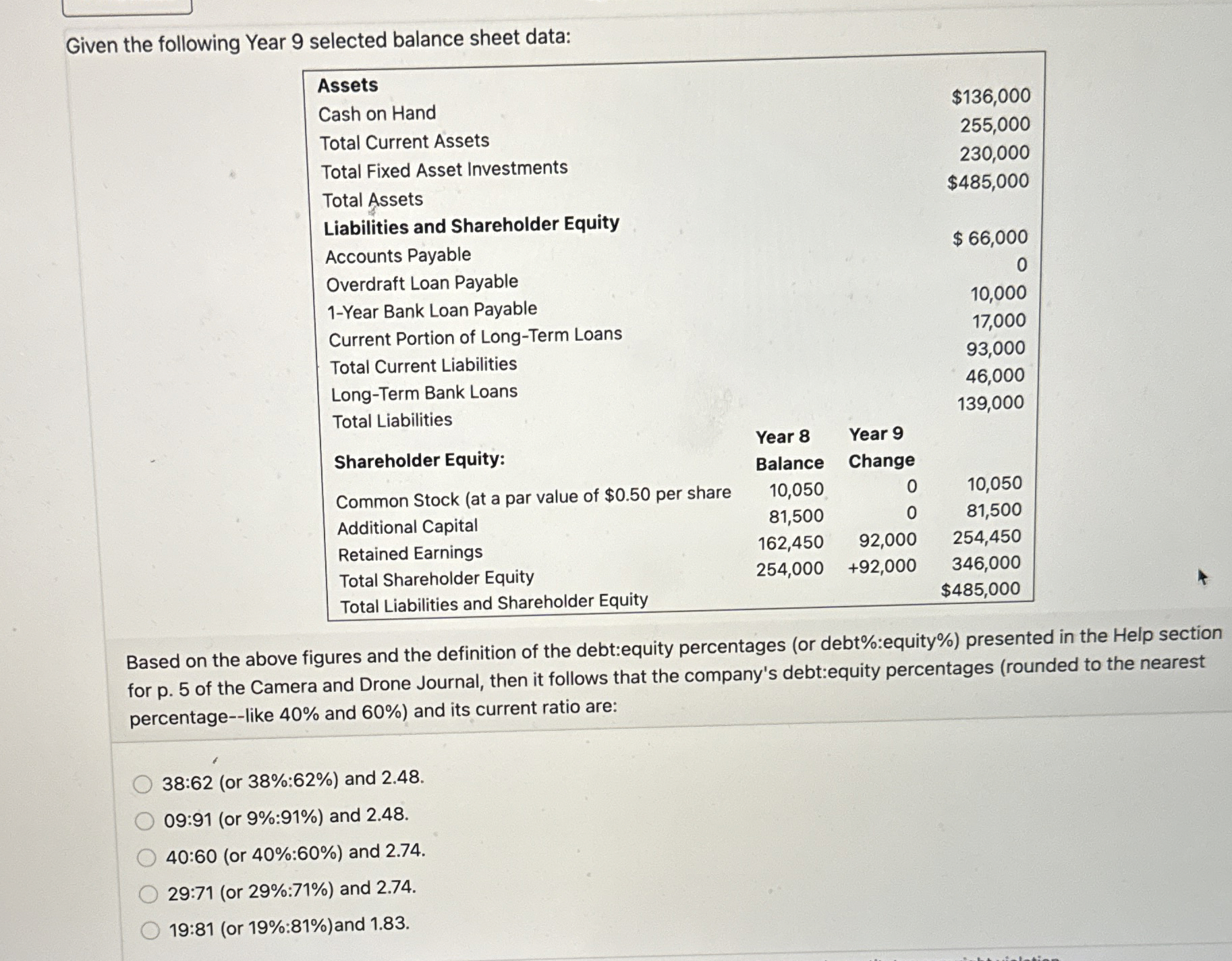

Question: Given the following Year 9 selected balance sheet data: table [ [ Assets , $ 1 3 6 , 0 0 0 ] ,

Given the following Year selected balance sheet data:

tableAssets$Cash on Hand,Total Current Assets,Total Fixed Asset Investments,Total AssetsLiabilities and Shareholder Equity,,,Accounts Payable,,,Overdraft Loan Payable,,,Year Bank Loan Payable,,,Current Portion of LongTerm Loans,,,Total Current Liabilities,,,LongTerm Bank Loans,,,Total Liabilities,,Year Shareholder Equity:,Balance,Change,Common Stock at a par value of $ per share,Common Stock at a par value of $ per share,Additional Capital,Retained Earnings,Total Shareholder Equity,,,$

Based on the above figures and the definition of the debt:equity percentages or debt:equity presented in the Help section for p of the Camera and Drone Journal, then it follows that the company's debt:equity percentages rounded to the nearest percentagelike and and its current ratio are:

:or : and

:or : and

:or : and

:or : and

:or : and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock