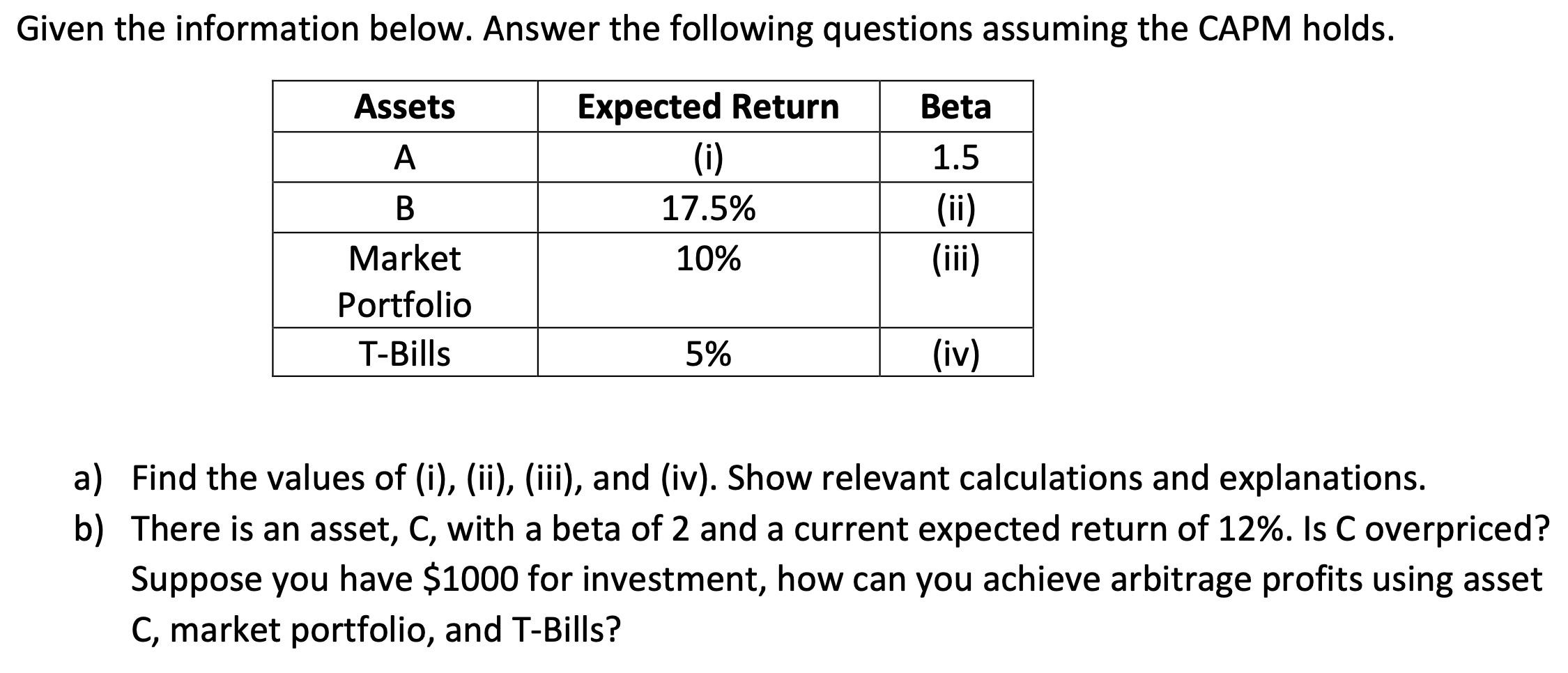

Question: Given the information below. Answer the following questions assuming the CAPM holds. Assets Expected Return A (i) B 17.5% Market 10% Portfolio T-Bills 5%

Given the information below. Answer the following questions assuming the CAPM holds. Assets Expected Return A (i) B 17.5% Market 10% Portfolio T-Bills 5% Beta 1.5 (ii) (iii) (iv) a) Find the values of (i), (ii), (iii), and (iv). Show relevant calculations and explanations. b) There is an asset, C, with a beta of 2 and a current expected return of 12%. Is C overpriced? Suppose you have $1000 for investment, how can you achieve arbitrage profits using asset C, market portfolio, and T-Bills?

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

a To find the values of i ii iii and iv we can use the Capital Asset Pricing Model CAPM formula Expected Return RiskFree Rate Beta Market Return RiskF... View full answer

Get step-by-step solutions from verified subject matter experts