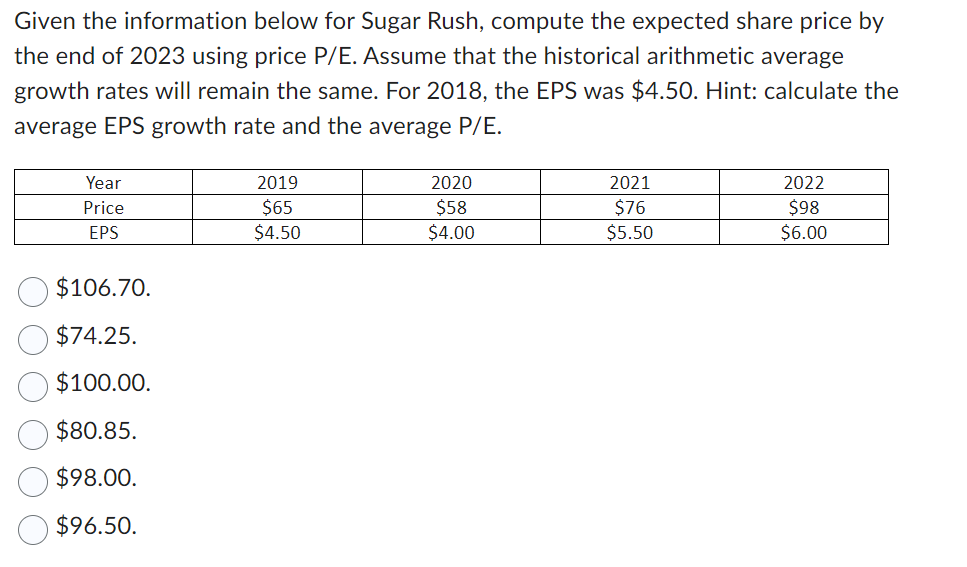

Question: Given the information below for Sugar Rush, compute the expected share price by the end of 2023 using price P/E. Assume that the historical arithmetic

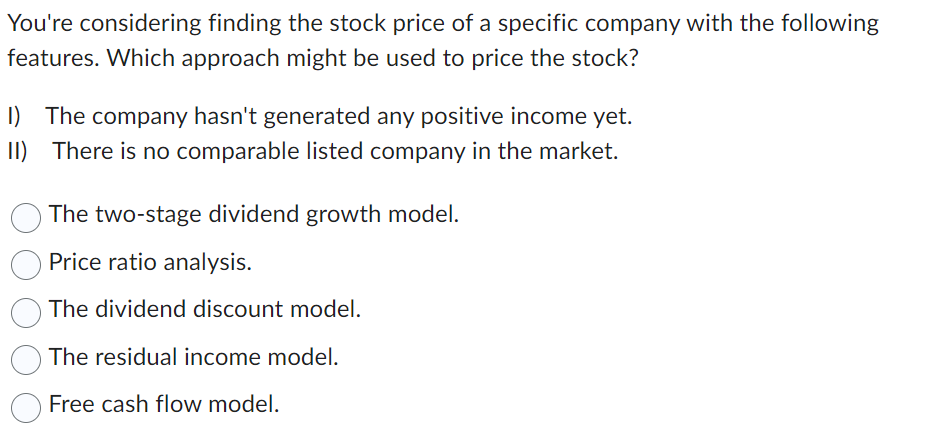

Given the information below for Sugar Rush, compute the expected share price by the end of 2023 using price P/E. Assume that the historical arithmetic average growth rates will remain the same. For 2018 , the EPS was $4.50. Hint: calculate the average EPS growth rate and the average P/E. $106.70. $74.25. $100.00. $80.85. $98.00. $96.50. You're considering finding the stock price of a specific company with the following features. Which approach might be used to price the stock? I) The company hasn't generated any positive income yet. II) There is no comparable listed company in the market. The two-stage dividend growth model. Price ratio analysis. The dividend discount model. The residual income model. Free cash flow model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts