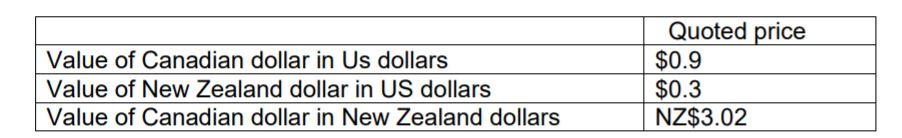

Question: Given the information below is triangular arbitrage possible (the attached contain the information)? If so explain the steps that would reflect triangular arbitrage, and compute

Given the information below is triangular arbitrage possible (the attached contain the information)? If so explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had $1,000,000 to use. Explain the market forces which will occur to eliminate any further possibilities of triangular arbitrage.

Value of Canadian dollar in Us dollars Value of New Zealand dollar in US dollars Value of Canadian dollar in New Zealand dollars Quoted price $0.9 $0.3 NZ$3.02

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

To determine if triangular arbitrage is possible we need to check if there is an arbitrage opportuni... View full answer

Get step-by-step solutions from verified subject matter experts