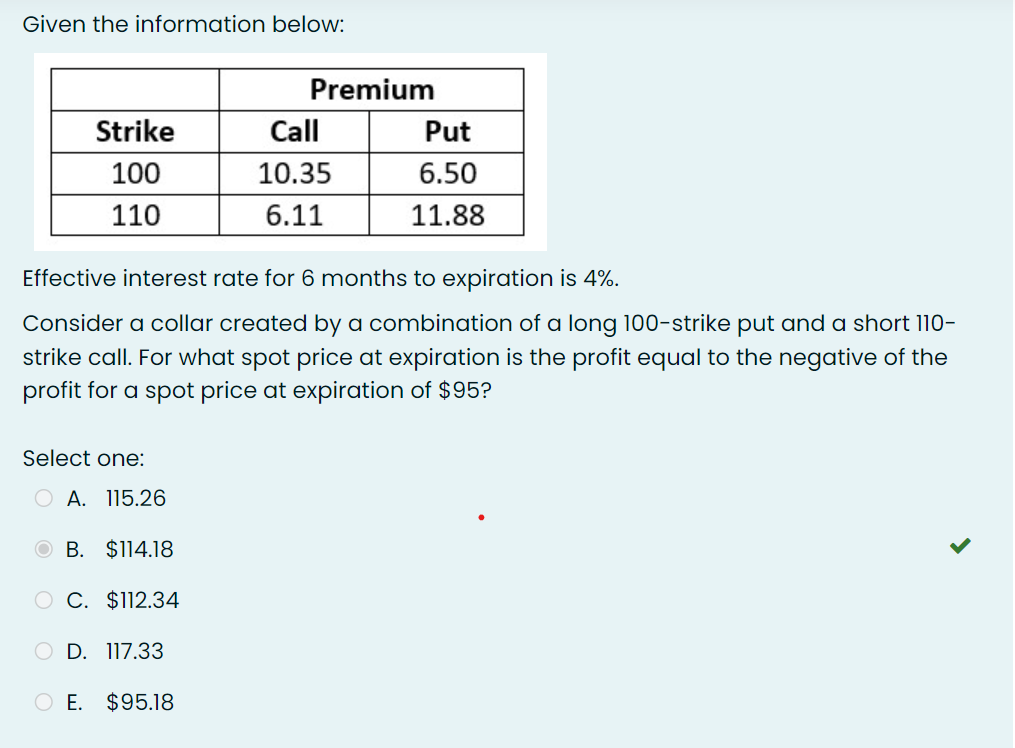

Question: Given the information below: Strike 100 110 Premium Call Put 10.35 6.50 6.11 11.88 Effective interest rate for 6 months to expiration is 4%. Consider

Given the information below: Strike 100 110 Premium Call Put 10.35 6.50 6.11 11.88 Effective interest rate for 6 months to expiration is 4%. Consider a collar created by a combination of a long 100-strike put and a short 110- strike call. For what spot price at expiration is the profit equal to the negative of the profit for a spot price at expiration of $95? Select one: O A. 115.26 OB. $114.18 O C. $112.34 O D. 117.33 O E. $95.18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts