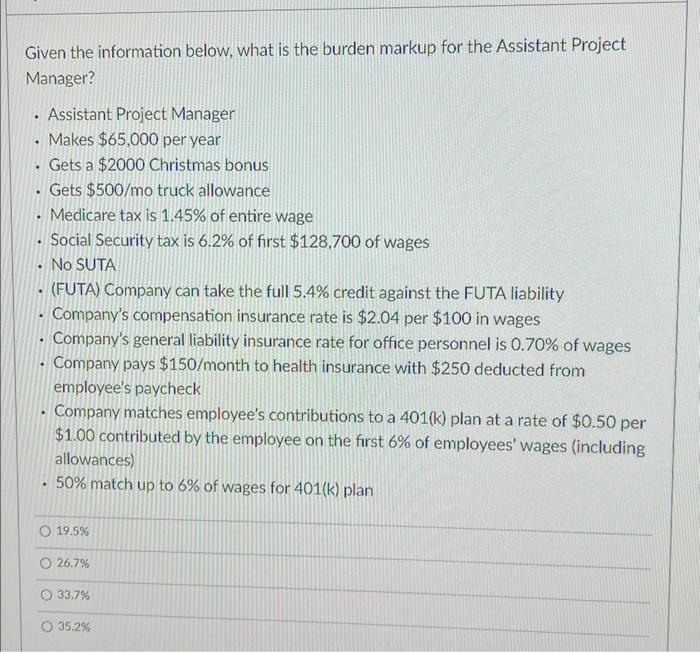

Question: Given the information below, what is the burden markup for the Assistant Project Manager? - Assistant Project Manager - Makes $65,000 per year - Gets

Given the information below, what is the burden markup for the Assistant Project Manager? - Assistant Project Manager - Makes $65,000 per year - Gets a \$2000 Christmas bonus - Gets $500/ mo truck allowance - Medicare tax is 1.45% of entire wage - Social Security tax is 6.2% of first $128,700 of wages - No SUTA - (FUTA) Company can take the full 5.4% credit against the FUTA liability - Company's compensation insurance rate is $2.04 per $100 in wages - Company's general liability insurance rate for office personnel is 0.70% of wages - Company pays $150/ month to health insurance with $250 deducted from employee's paycheck - Company matches employee's contributions to a 401(k) plan at a rate of $0.50 per $1.00 contributed by the employee on the first 6% of employees' wages (including allowances) - 50% match up to 6% of wages for 401(k) plan 19.5% 26.7% 33.7% 35.2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts