Question: Given the information in the preceding balance sheet-and assuming that Cold Goose Metal Works Inc. has 50 million shares of common stock cutstanding-read each of

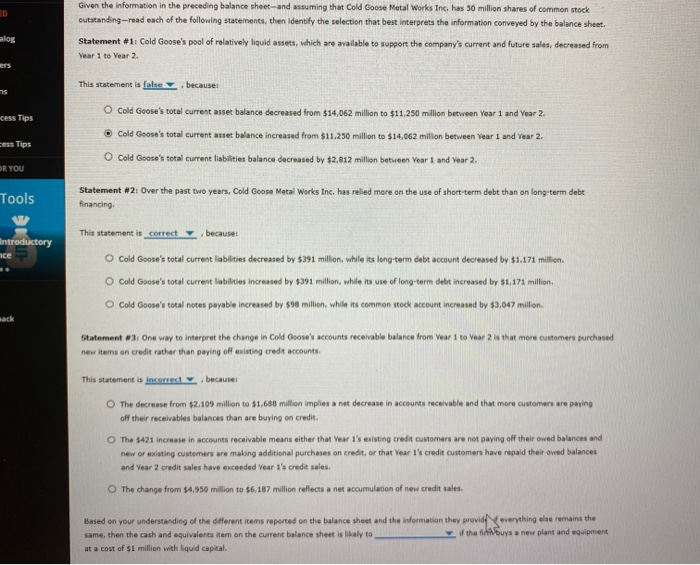

Given the information in the preceding balance sheet-and assuming that Cold Goose Metal Works Inc. has 50 million shares of common stock cutstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet. alos Statement #1: Cold Goose's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2 This statement is false becauses O Cold Goose's total current asset balance decreased from $14,062 million to $11,250 million between Year 1 and Year 2. cess Tips Cold Goose's total current asset balance increased from $11.250 million to $14,062 million between Year 1 and Year 2. cess Tips O Cold Goose's total current liabilities balance decreased by $2.612 million between Year 1 and Year 2 OR YOU Tools Statement #2: Over the past two years, Cold Goose Metal Works Inc. has relied more on the use of short term debt than on long term debt financing This statement is correct because Introductory nce O Cold Goose's total current liabilities decreased by $391 million, while its long-term debt account decreased by $1.171 million O Cold Goose's total current liabilities increased by $391 million, while its use of long-term debt increased by $1,171 million O Cold Goose's total notes payable increased by $98 million, while its common stock account increased by $3,047 million. mack Statement #3 One way to interpret the change in Cold Goose's accounts receivable balance from Year 1 to Ver 2 is that more customers purchased new items on credit rather than paying off existing credit accounts. This statement is income , because The decrease from $2,109 million to $1,688 million implies a net decrease in accounts receivable and that more customers are paying off their receivables balances than are buying on credit. The 1421 increase in accounts receivable means either that year 1's existing credit customers are not paying off their owed balances and new or existing customers are making additional purchases on credit, or that year I's credit customers have repaid their owed balances and Year 2 credit sales have exceeded Year I's credit sales. The change from 1,950 milion to $6,187 million reflects a net accumulation of new credit sales Based on your understanding of the different items reported on the balance sheet and the information they provideverything else remains the same, then the cash and equivalents em on the current balance sheet is likely to if the filibus a new plant and equipment at a cost of $1 million with liquid capital. Given the information in the preceding balance sheet-and assuming that Cold Goose Metal Works Inc. has 50 million shares of common stock cutstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet. alos Statement #1: Cold Goose's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2 This statement is false becauses O Cold Goose's total current asset balance decreased from $14,062 million to $11,250 million between Year 1 and Year 2. cess Tips Cold Goose's total current asset balance increased from $11.250 million to $14,062 million between Year 1 and Year 2. cess Tips O Cold Goose's total current liabilities balance decreased by $2.612 million between Year 1 and Year 2 OR YOU Tools Statement #2: Over the past two years, Cold Goose Metal Works Inc. has relied more on the use of short term debt than on long term debt financing This statement is correct because Introductory nce O Cold Goose's total current liabilities decreased by $391 million, while its long-term debt account decreased by $1.171 million O Cold Goose's total current liabilities increased by $391 million, while its use of long-term debt increased by $1,171 million O Cold Goose's total notes payable increased by $98 million, while its common stock account increased by $3,047 million. mack Statement #3 One way to interpret the change in Cold Goose's accounts receivable balance from Year 1 to Ver 2 is that more customers purchased new items on credit rather than paying off existing credit accounts. This statement is income , because The decrease from $2,109 million to $1,688 million implies a net decrease in accounts receivable and that more customers are paying off their receivables balances than are buying on credit. The 1421 increase in accounts receivable means either that year 1's existing credit customers are not paying off their owed balances and new or existing customers are making additional purchases on credit, or that year I's credit customers have repaid their owed balances and Year 2 credit sales have exceeded Year I's credit sales. The change from 1,950 milion to $6,187 million reflects a net accumulation of new credit sales Based on your understanding of the different items reported on the balance sheet and the information they provideverything else remains the same, then the cash and equivalents em on the current balance sheet is likely to if the filibus a new plant and equipment at a cost of $1 million with liquid capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts