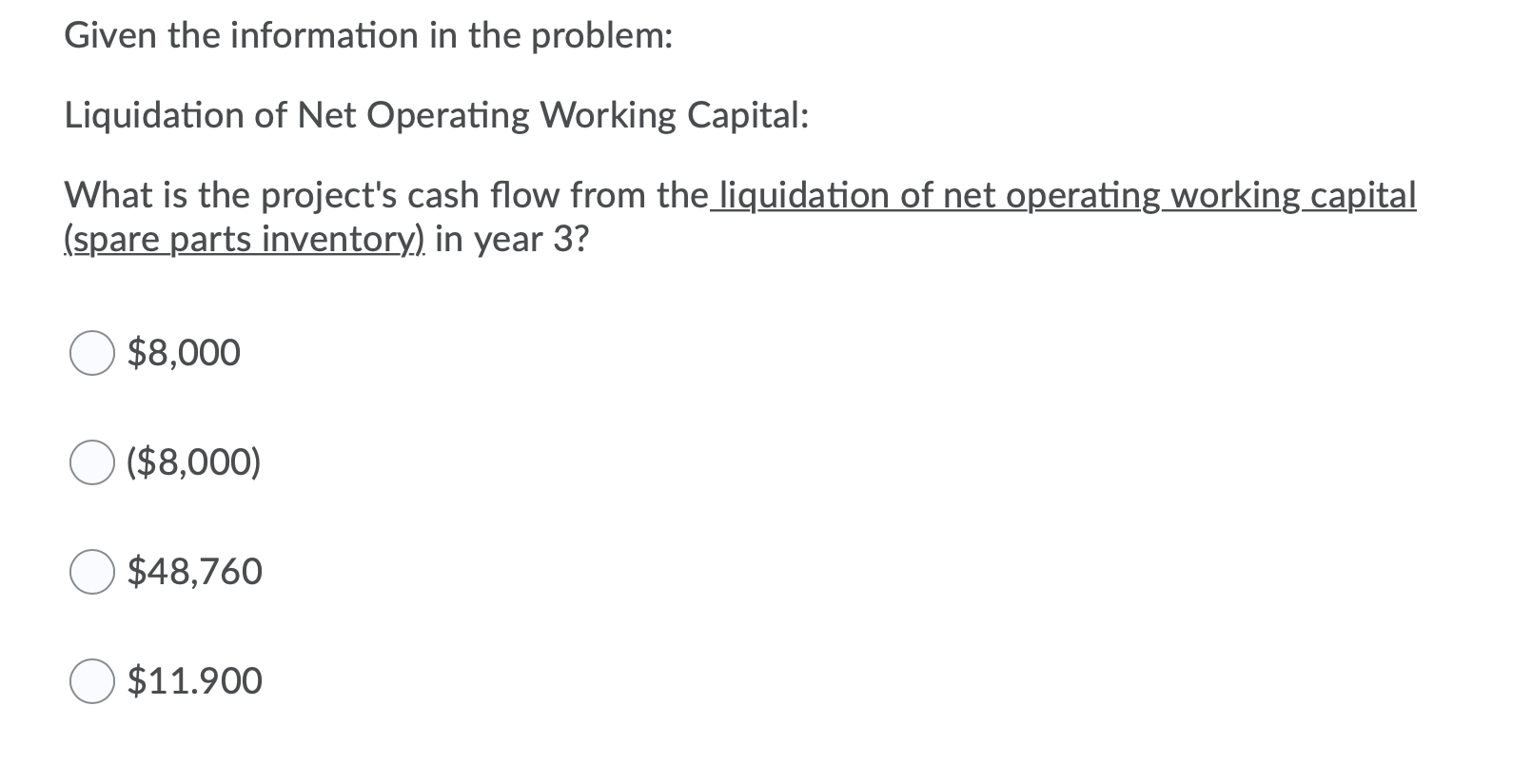

Question: Given the information in the problem: Liquidation of Net Operating Working Capital: What is the project's cash flow from the liquidation of net operating working

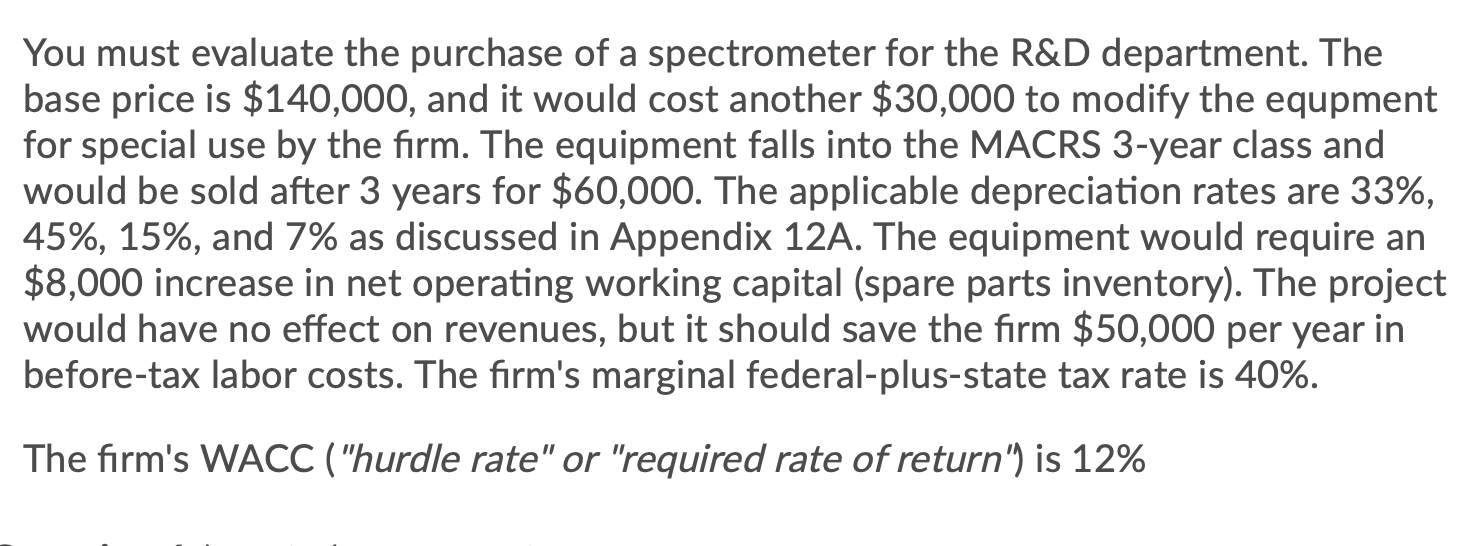

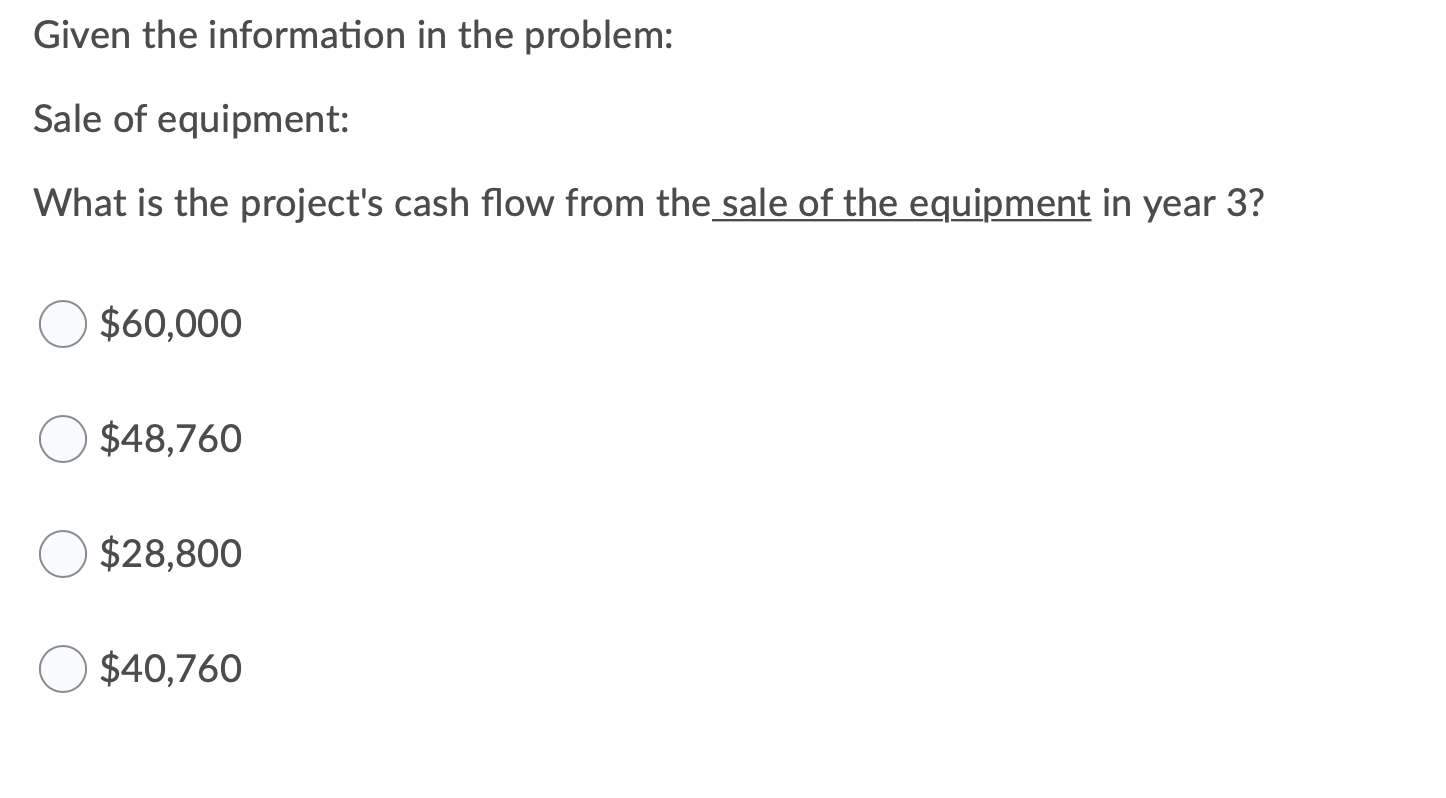

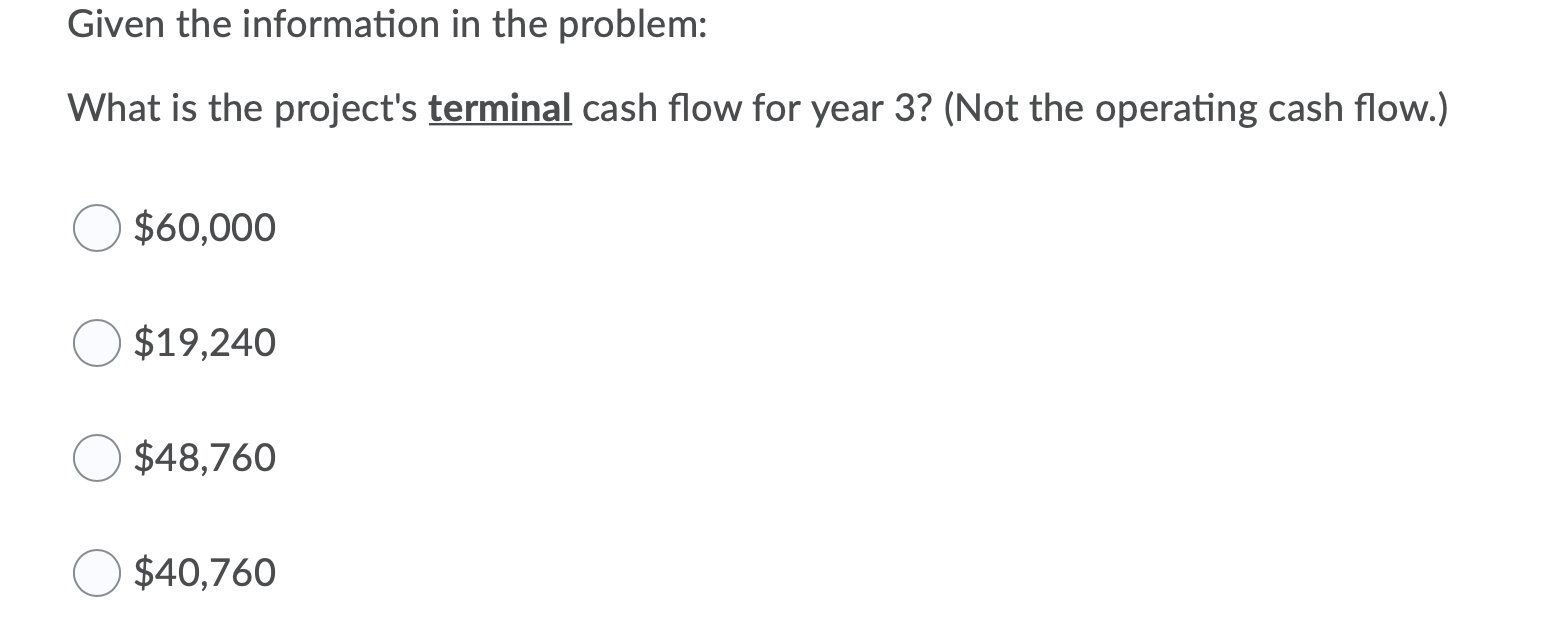

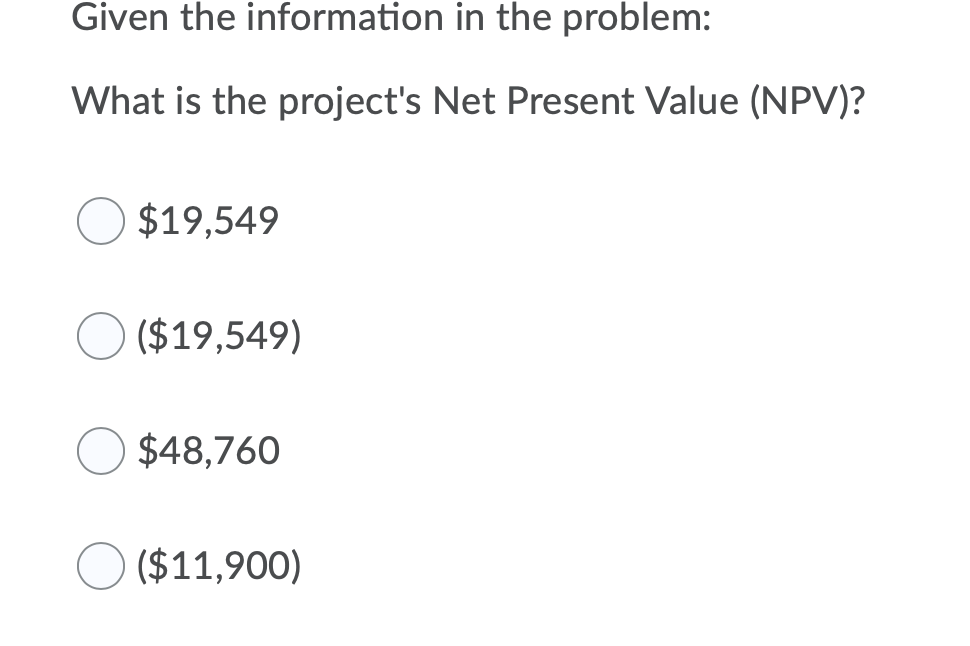

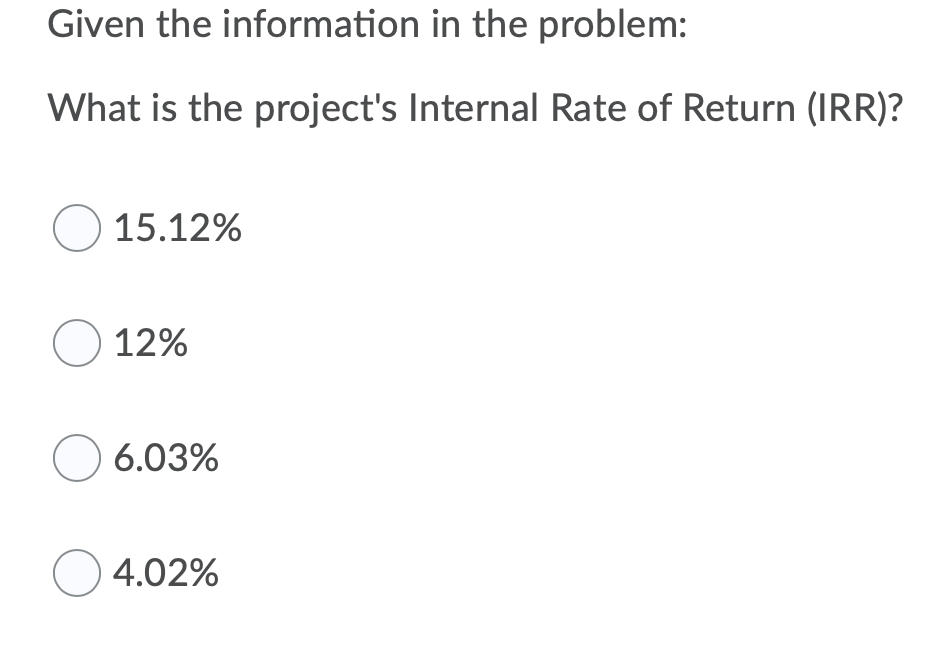

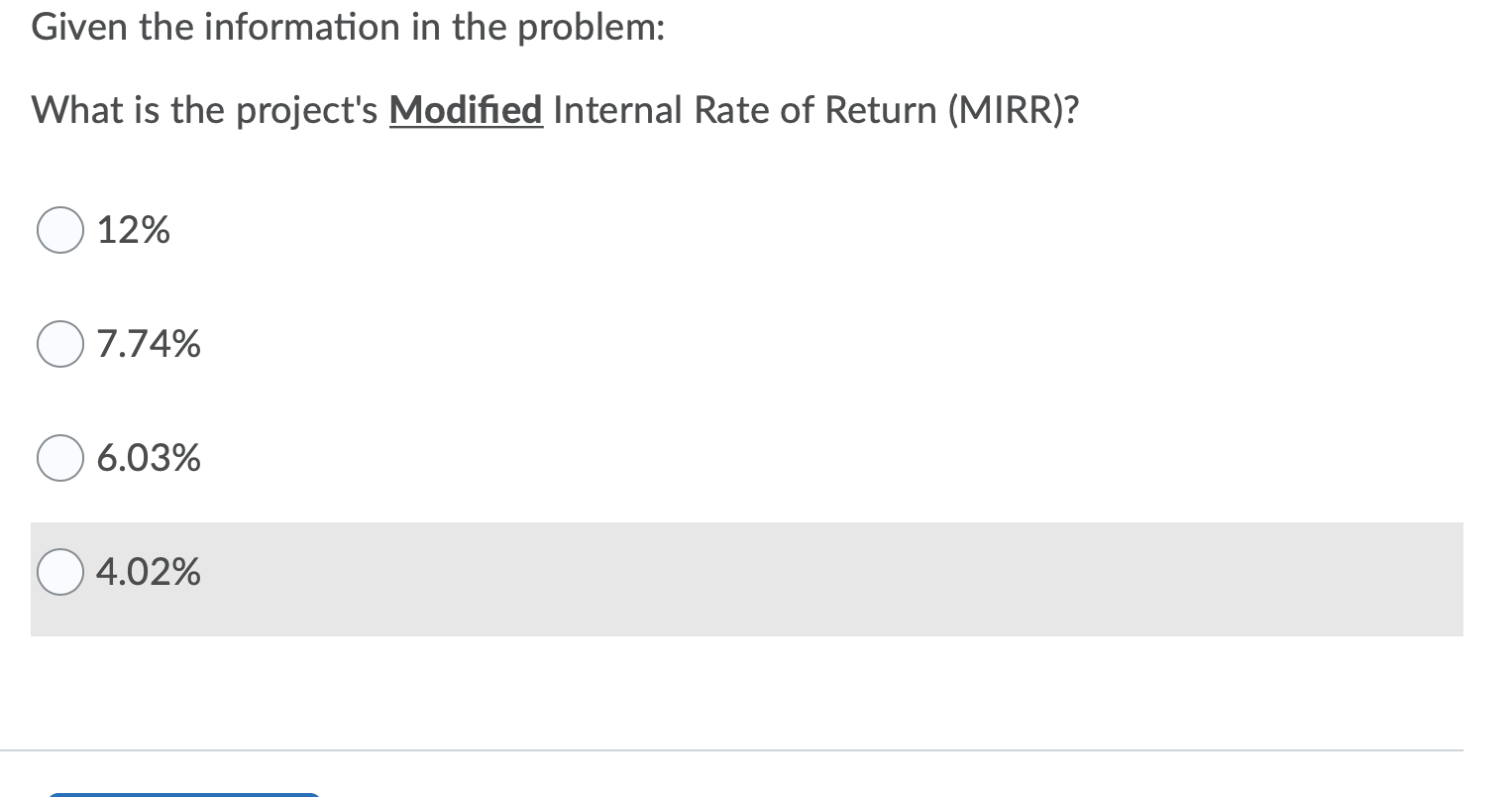

Given the information in the problem: Liquidation of Net Operating Working Capital: What is the project's cash flow from the liquidation of net operating working capital (spare parts inventory), in year 3? $8,000 ($8,000) $48,760 $11.900 Given the information in the problem: What is the project's terminal cash flow for year 3? (Not the operating cash flow.) $60,000 $19,240 $48,760 $40,760 Given the information in the problem: What is the project's Net Present Value (NPV)? $19,549 ($19,549) $48,760 ($11,900) Given the information in the problem: What is the project's Internal Rate of Return (IRR)? O 15.12% O 12% 6.03% % 04.02% Given the information in the problem: What is the project's Modified Internal Rate of Return (MIRR)? 12% 7.74% 6.03% 4.02% Given the information in the problem: Liquidation of Net Operating Working Capital: What is the project's cash flow from the liquidation of net operating working capital (spare parts inventory), in year 3? $8,000 ($8,000) $48,760 $11.900 Given the information in the problem: What is the project's terminal cash flow for year 3? (Not the operating cash flow.) $60,000 $19,240 $48,760 $40,760 Given the information in the problem: What is the project's Net Present Value (NPV)? $19,549 ($19,549) $48,760 ($11,900) Given the information in the problem: What is the project's Internal Rate of Return (IRR)? O 15.12% O 12% 6.03% % 04.02% Given the information in the problem: What is the project's Modified Internal Rate of Return (MIRR)? 12% 7.74% 6.03% 4.02%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts