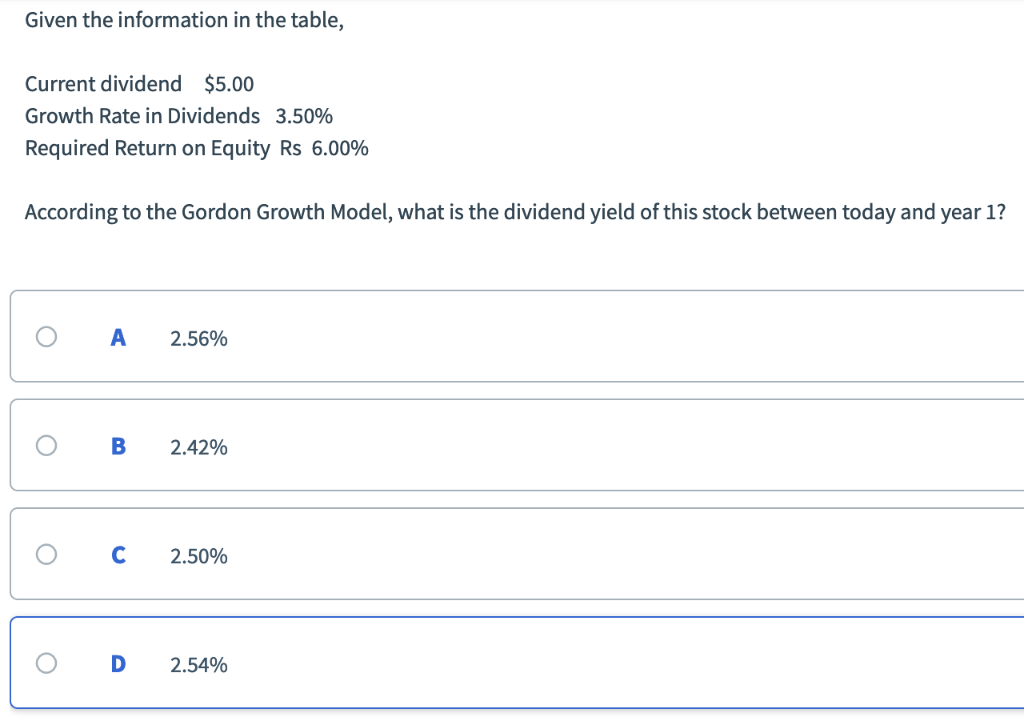

Question: Given the information in the table, Current dividend $5.00 Growth Rate in Dividends 3.50% Required Return on Equity Rs 6.00% According to the Gordon Growth

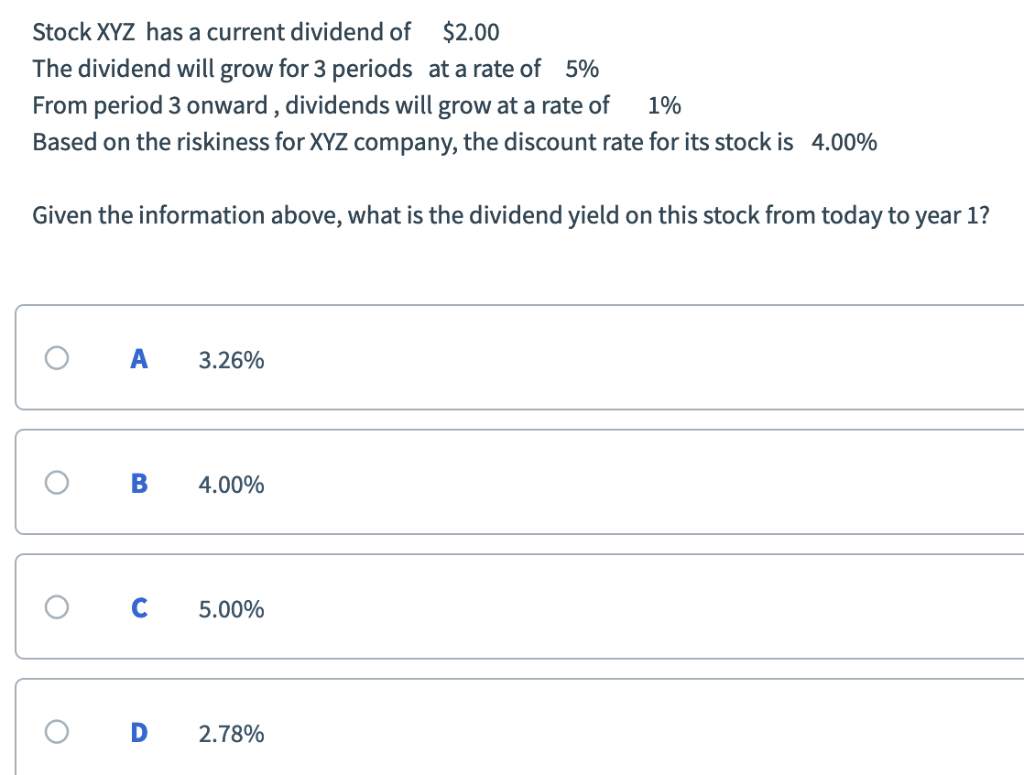

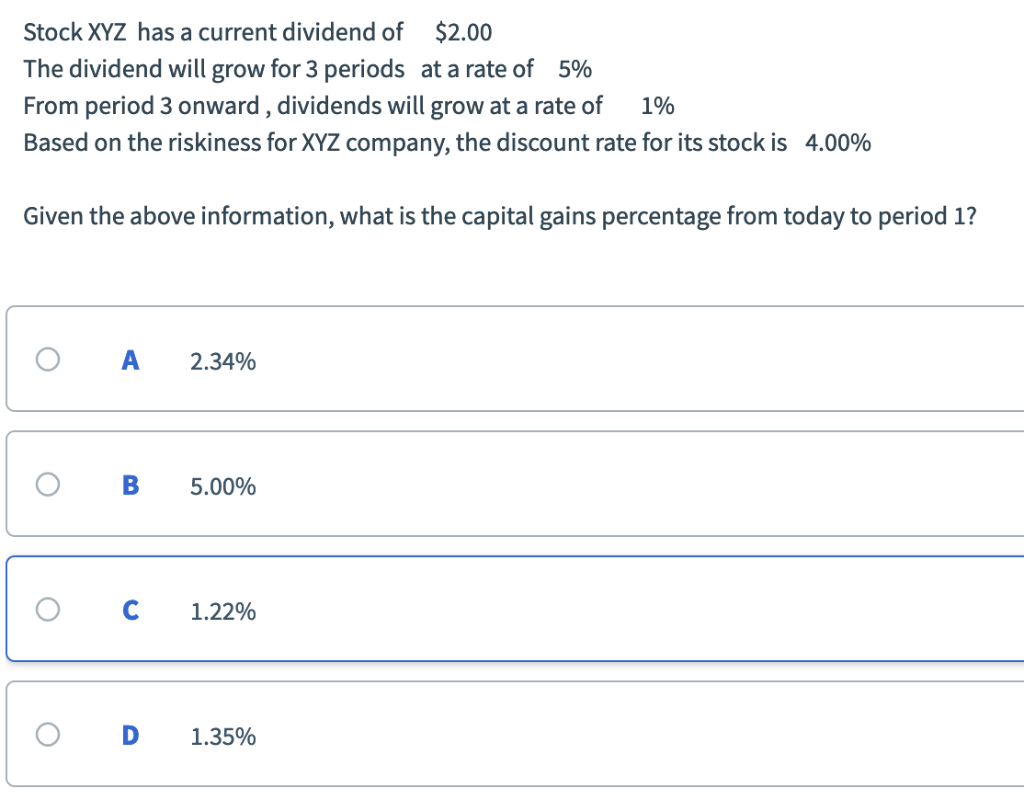

Given the information in the table, Current dividend $5.00 Growth Rate in Dividends 3.50% Required Return on Equity Rs 6.00% According to the Gordon Growth Model, what is the dividend yield of this stock between today and year 1? 0 A 2.56% O B 2.42% 2.50% O D 2.54% Stock XYZ has a current dividend of $2.00 The dividend will grow for 3 periods at a rate of 5% From period 3 onward, dividends will grow at a rate of 1% Based on the riskiness for XYZ company, the discount rate for its stock is 4.00% Given the information above, what is the dividend yield on this stock from today to year 1? 0 A 3.26% 0 B 4.00% O C 5.00% O D 2.78% Stock XYZ has a current dividend of $2.00 The dividend will grow for 3 periods at a rate of 5% From period 3 onward, dividends will grow at a rate of 1% Based on the riskiness for XYZ company, the discount rate for its stock is 4.00% Given the above information, what is the capital gains percentage from today to period 1? 0 A 2.34% 5.00% 1.22% O D 1.35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts