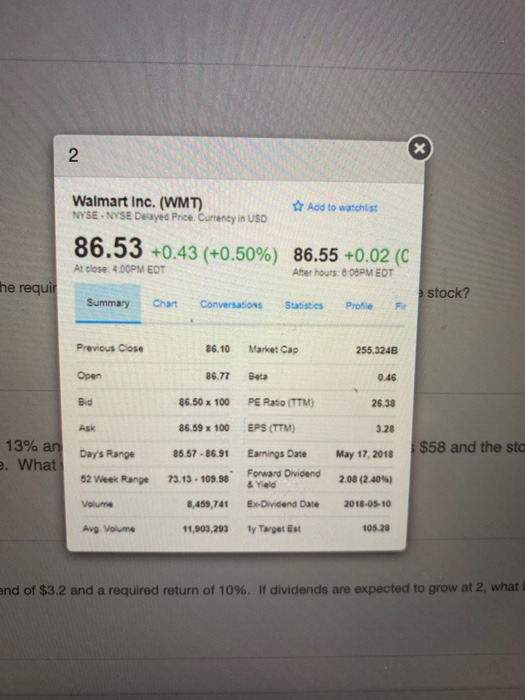

Question: Given the information in the table, if the required return on the stock is 12.8%, what is the value of the stock? Walmart Inc. (WMT)

Given the information in the table, if the required return on the stock is 12.8%, what is the value of the stock?

Walmart Inc. (WMT) NYSE - NYSE Delayed Price Currency in USD Add to watchlist 86.53 +0.43 (+0.50%) 86.55 +0.02 (C At close: 4:00PM EDT Afterhours: 8.00PM EDT a stock? Summary Chart Conversations Statistics Profile he requir Previous Close 86.10 Marke: Cap 255.324B Open 86.77 Beta 0.46 Bid 26.50 x 100 PE Ratio (TTM) 26.38 Ask 86.59 x 100 EPS (TTM) 3.28 13% an e. What May 17, 2018 $58 and the sto Days Range 52 Week Range 85.57 - 86.91 73.13 - 109.98 Earnings Date Forward Dividend & Yield Ex-Dividend Date 208 (2.40%) Volume 8,459,741 2018-05-10 Avg. Volume 11,903,293 Ty Target Est 105.20 end of $3.2 and a required return of 10%. If dividends are expected to grow at 2, what Walmart Inc. (WMT) NYSE - NYSE Delayed Price Currency in USD Add to watchlist 86.53 +0.43 (+0.50%) 86.55 +0.02 (C At close: 4:00PM EDT Afterhours: 8.00PM EDT a stock? Summary Chart Conversations Statistics Profile he requir Previous Close 86.10 Marke: Cap 255.324B Open 86.77 Beta 0.46 Bid 26.50 x 100 PE Ratio (TTM) 26.38 Ask 86.59 x 100 EPS (TTM) 3.28 13% an e. What May 17, 2018 $58 and the sto Days Range 52 Week Range 85.57 - 86.91 73.13 - 109.98 Earnings Date Forward Dividend & Yield Ex-Dividend Date 208 (2.40%) Volume 8,459,741 2018-05-10 Avg. Volume 11,903,293 Ty Target Est 105.20 end of $3.2 and a required return of 10%. If dividends are expected to grow at 2, what

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts