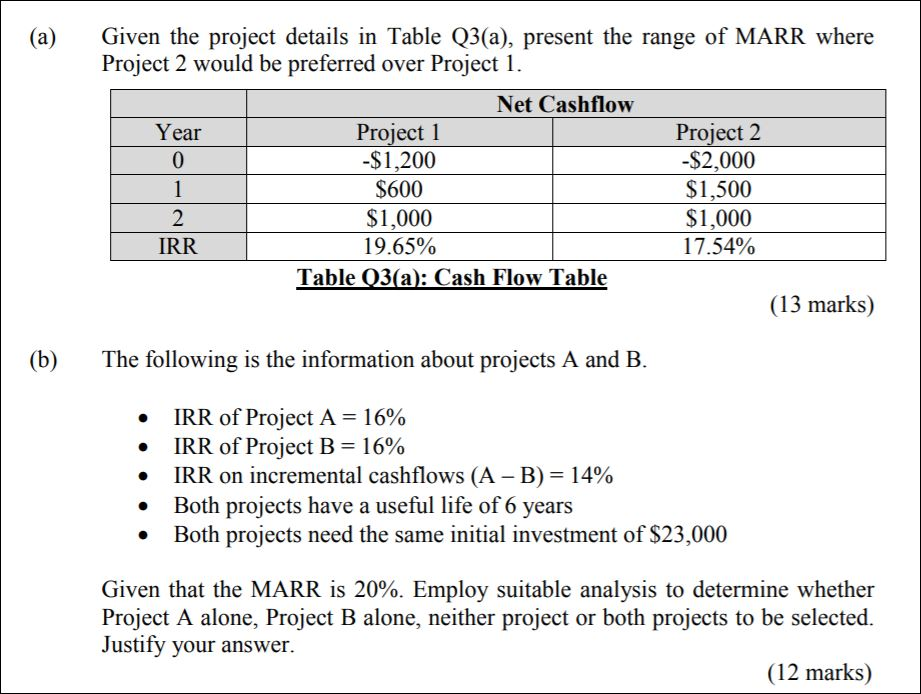

Question: Given the project details in Table Q3(a), present the range of MARR where Project 2 would be preferred over Project 1 (a) Net Cashflow Project

Given the project details in Table Q3(a), present the range of MARR where Project 2 would be preferred over Project 1 (a) Net Cashflow Project 2 -$2,000 $1,500 $1,000 17.54% Project 1 -$1,200 Year 0 1 $600 2 $1,000 19.65% IRR Table 03(a): Cash Flow Table (13 marks) The following is the information about projects A and B (b) IRR of Project A 16% IRR of Project B 16% IRR on incremental cashflows (A - B) 14% Both projects have a useful life of 6 years Both projects need the same initial investment of $23,000 Given that the MARR is 20%. Employ suitable analysis to determine whether Project A alone, Project B alone, neither project or both projects to be selected Justify your answer (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts