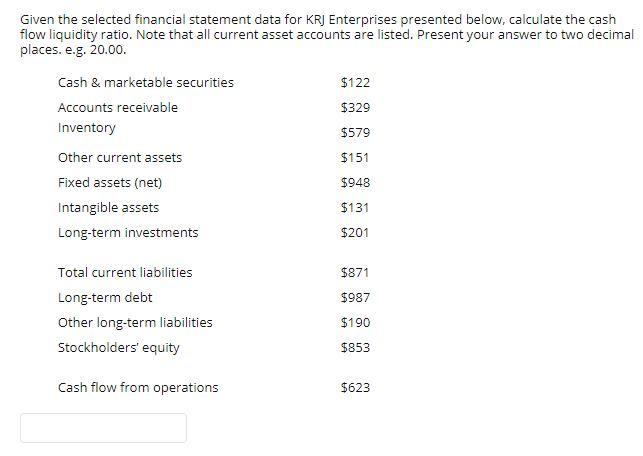

Question: Given the selected financial statement data for KRJ Enterprises presented below, calculate the cash flow liquidity ratio. Note that all current asset accounts are listed.

Given the selected financial statement data for KRJ Enterprises presented below, calculate the cash flow liquidity ratio. Note that all current asset accounts are listed. Present your answer to two decimal places. e.g. 20.00. $122 $329 $579 Cash & marketable securities Accounts receivable Inventory Other current assets Fixed assets (net) Intangible assets Long-term investments $151 $948 $131 $201 $871 $987 Total current liabilities Long-term debt Other long-term liabilities Stockholders' equity $190 $853 Cash flow from operations $623

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts