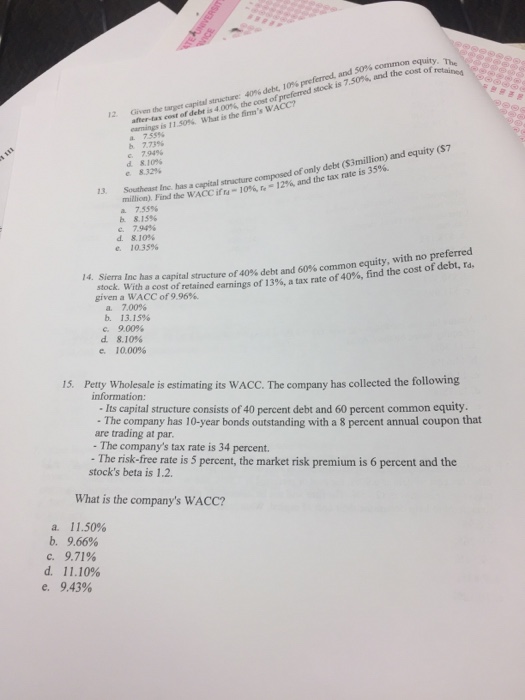

Question: Given the target capta, structure 40% debt 10% preferred andso sconnon equity after-tax cost ofdebts4 00% the cost of preferred stock is 7.50%, and te

Given the target capta, structure 40% debt 10% preferred andso sconnon equity after-tax cost ofdebts4 00% the cost of preferred stock is 7.50%, and te coto 12. ?mangs is 11.50%. What is the finn's wACC? 7.55% b. 7.73% 7.94% d.8.10% e.8.32% of only debt (S3million) and equity ($7 13 Southeast Inc has a capital structure million). Find the WACC ifra-10%, re-12%, and the tax rate is 35%. a 7.55% b. 8.15% c. 7.94% d.8.10% e. 10.35% 14, Sierra Inc has a capital structure of 40% debt and 60% common equity, wn with no preferred find the cost of debt, ra. given a WACC foretained earnings of 13%, a tax rate of 40% given a WACC of 9.96%. a. 7.00% b. 13.15% c.900% d. 8.10% e. 10.00% 1S. Pety Wholesale is estimating its WACC. The company has collected the following information Its capital structure consists of 40 percent debt and 60 percent common equity. - The company has 10-year bonds outstanding with a 8 percent annual coupon that are trading at par. The company's tax rate is 34 percent. - The risk-free rate is 5 percent, the market risk premium is 6 percent and the stock's beta is 1.2 What is the company's WACc? 11.50% b. 9.66% c. 9.71% d. 11.10% 9.43% e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts