Question: Given the TODAY capacity utilization, and thinking on a linear scale up to 100%, how many more units could William Company handle as part of

- Given the TODAY capacity utilization, and thinking on a linear scale up to 100%, how many more units could William Company handle as part of their supply chain operation?

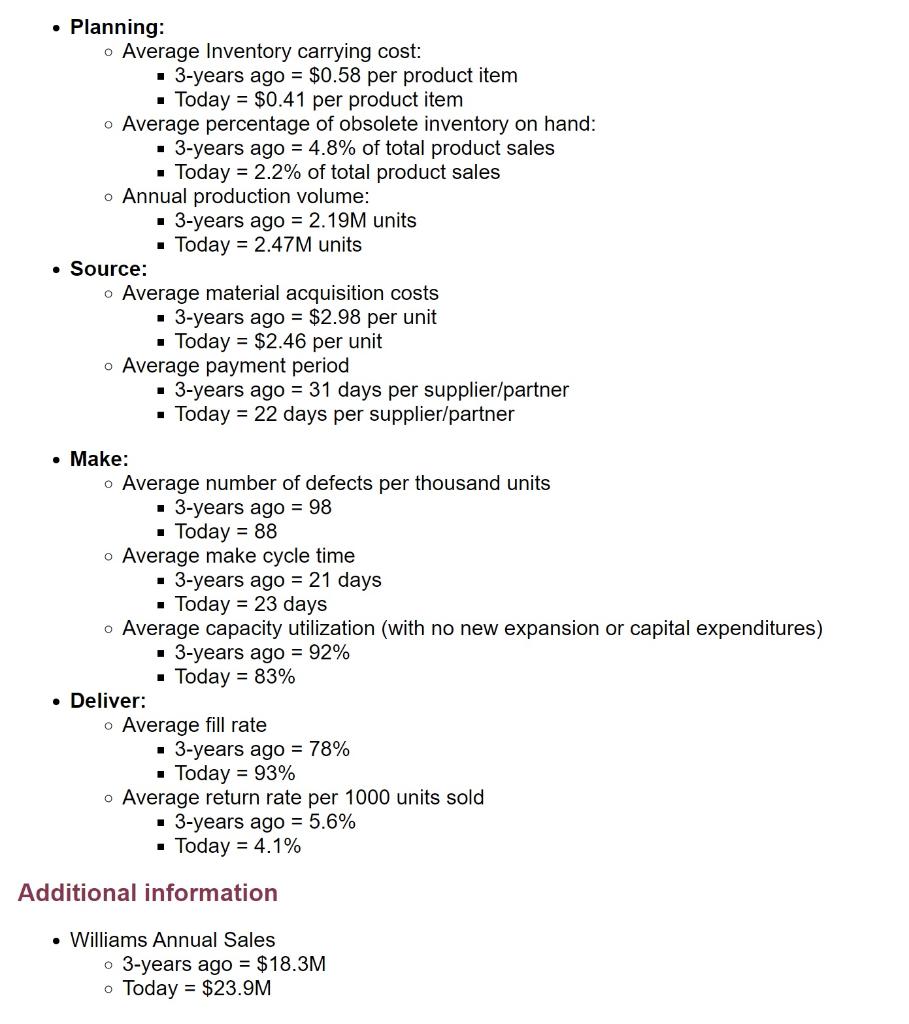

Planning: o Average Inventory carrying cost: 3-years ago = $0.58 per product item Today = $0.41 per product item Average percentage of obsolete inventory on hand: 3-years ago = 4.8% of total product sales Today = 2.2% of total product sales o Annual production volume: 3-years ago = 2.19M units Today = 2.47M units Source: o Average material acquisition costs 3-years ago = $2.98 per unit Today = $2.46 per unit o Average payment period 3-years ago = 31 days per supplier/partner Today = 22 days per supplier/partner 1 Make: Average number of defects per thousand units 3-years ago = 98 Today = 88 o Average make cycle time 3-years ago = 21 days Today = 23 days o Average capacity utilization (with no new expansion or capital expenditures) 3-years ago = 92% Today = 83% Deliver: o Average fill rate 3-years ago = 78% Today = 93% o Average return rate per 1000 units sold 3-years ago = 5.6% Today = 4.1% Additional information . Williams Annual Sales o 3-years ago = $18.3M o Today = $23.9M Planning: o Average Inventory carrying cost: 3-years ago = $0.58 per product item Today = $0.41 per product item Average percentage of obsolete inventory on hand: 3-years ago = 4.8% of total product sales Today = 2.2% of total product sales o Annual production volume: 3-years ago = 2.19M units Today = 2.47M units Source: o Average material acquisition costs 3-years ago = $2.98 per unit Today = $2.46 per unit o Average payment period 3-years ago = 31 days per supplier/partner Today = 22 days per supplier/partner 1 Make: Average number of defects per thousand units 3-years ago = 98 Today = 88 o Average make cycle time 3-years ago = 21 days Today = 23 days o Average capacity utilization (with no new expansion or capital expenditures) 3-years ago = 92% Today = 83% Deliver: o Average fill rate 3-years ago = 78% Today = 93% o Average return rate per 1000 units sold 3-years ago = 5.6% Today = 4.1% Additional information . Williams Annual Sales o 3-years ago = $18.3M o Today = $23.9M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts