Question: Given the yield curve below and a forecasted MRPn = 0.25 (n - 1)%, what is the expected 1-year rate forecast by the liquidity theory

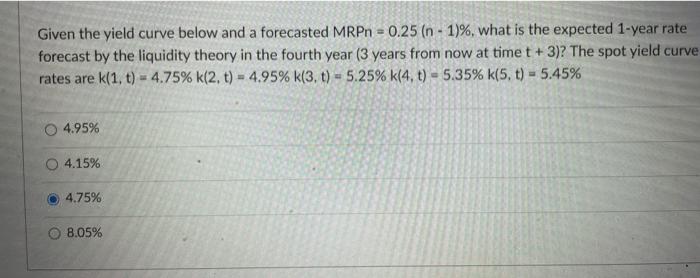

Given the yield curve below and a forecasted MRPn = 0.25 (n - 1)%, what is the expected 1-year rate forecast by the liquidity theory in the fourth year (3 years from now at time t + 3)? The spot yield curve rates are k(1, t) = 4.75% k(2. t) = 4.95% k(3. t) = 5.25% k(4, t) - 5.35% k(5. t) - 5.45% 4.95% 4.15% 4.75% O 8.05%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts