Question: Given this data and assuming that the revised collection policy is implemented, complete the following statements. (Note: Round your answers to the nearest doliar.) Robbin's

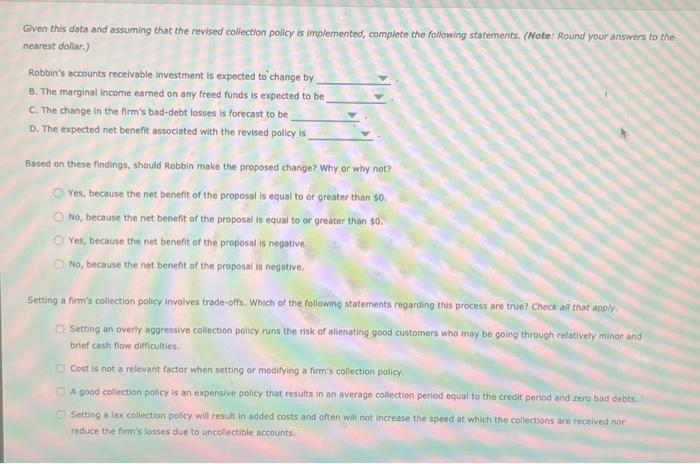

Given this data and assuming that the revised collection policy is implemented, complete the following statements. (Note: Round your answers to the nearest doliar.) Robbin's accounts receivable investment is expected to change by B. The marginal income earned on any freed funds is expected to be C. The change in the firm's bad-debt losses is forecast to be D. The expected net benefit associated with the revised policy is Based on these findings, should Robbin make the proposed change? Why or why not? Yes, because the net beneft of the proposal is equal to or greater than 50. No, because the net beneft of the proposal is equal to or greater than $0. Yes, because the net benefit of the proposal is negative. No, because the net benefit of the proposal is negative. Setting a firm's collection policy involves trade-offs. Which of the following statements regarding this process are true? Check alf that apply. Setting an overly aggressive collection policy runs the risk of alienating good custorners who may be going through relatively minor and brief cash how difriculties. Cost is not a relevant factor when setting or modifying a firm's coliection policy. A good collection policy is an expenseve policy that results in an average collection period equal to the credit period and aero bad Aebts. Setting a lax collection policy will result in added costs and often will not increase the speed at which the collections-are received nor reduce the firm's losses due to uncollectible accounts. Given this data and assuming that the revised collection policy is implemented, complete the following statements. (Note: Round your answers to the nearest doliar.) Robbin's accounts receivable investment is expected to change by B. The marginal income earned on any freed funds is expected to be C. The change in the firm's bad-debt losses is forecast to be D. The expected net benefit associated with the revised policy is Based on these findings, should Robbin make the proposed change? Why or why not? Yes, because the net beneft of the proposal is equal to or greater than 50. No, because the net beneft of the proposal is equal to or greater than $0. Yes, because the net benefit of the proposal is negative. No, because the net benefit of the proposal is negative. Setting a firm's collection policy involves trade-offs. Which of the following statements regarding this process are true? Check alf that apply. Setting an overly aggressive collection policy runs the risk of alienating good custorners who may be going through relatively minor and brief cash how difriculties. Cost is not a relevant factor when setting or modifying a firm's coliection policy. A good collection policy is an expenseve policy that results in an average collection period equal to the credit period and aero bad Aebts. Setting a lax collection policy will result in added costs and often will not increase the speed at which the collections-are received nor reduce the firm's losses due to uncollectible accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts