Question: given this information: answer part b) Presented here are selected trassctions for Cullumber Limites tor 2018. Cillumber uses straight-line deprecistion and reconds adjustingentries annually. Jan

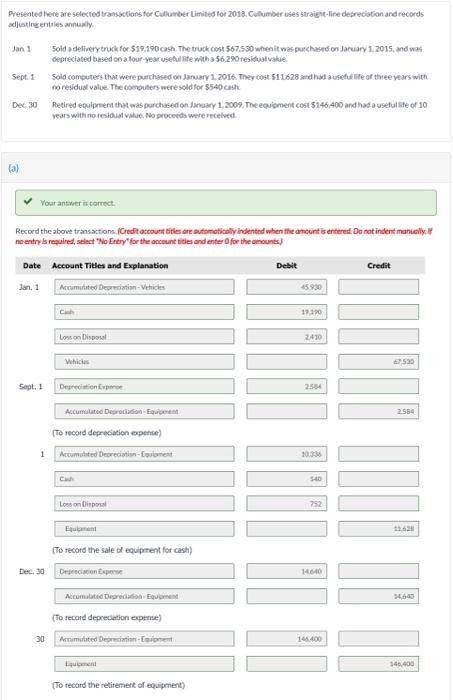

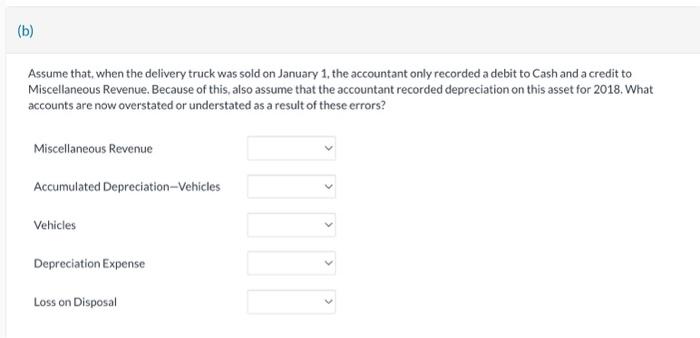

Presented here are selected trassctions for Cullumber Limites tor 2018. Cillumber uses straight-line deprecistion and reconds adjustingentries annually. Jan 1 Sold a delimery trugk for 519,190 cash. The truck cost 567,530 when it was purchascd on Jaruary 1.2015 , and was depreciated based on a tour-year usehil afe whth 5.56290 resinial value Seot. 1 Sold computers that were purchased on January 1. 2016. They cost 511.628 and had a usefulile of three vars with no residual value. The comeuters were sold for 5540cas. Dex: 30. Retired equiprnent that was purchased on Jaruary 1, 2009. The equigment cost $146,400 and had a aseful site of 10 vears with no tesioual vilue. No procetds were recelved. (a) Record the aboue transactions ICredit oscount bitles are sutsmoticaly indentad when ffe amount is entered. Do not indent manualiy. If noentry is required, salect 'No Entry" for the acceunt titles and enter 0 for the amounts) Assume that, when the delivery truck was sold on January 1 , the accountant only recorded a debit to Cash and a credit to Miscellaneous Revenue. Because of this, also assume that the accountant recorded depreciation on this asset for 2018 . What accounts are now overstated or understated as a result of these errors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts