Question: Given this information, is locational arbitrage possible? Show how the corporate treasury could make geographic arbitrage profits with the two different exchange rate quotes if

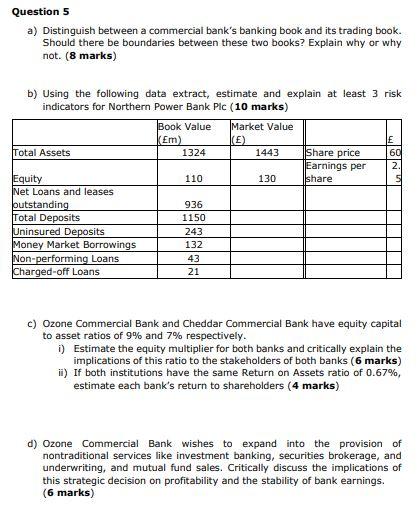

Given this information, is locational arbitrage possible? Show how the corporate treasury could make geographic arbitrage profits with the two different exchange rate quotes if they want to invest E100,000. (9 marks) Question 5 a) Distinguish between a commercial bank's banking book and its trading book. Should there be boundaries between these two books? Explain why or why not. (8 marks) b) Using the following data extract, estimate and explain at least 3 risk indicators for Northern Power Bank Plc (10 marks) c) Ozone Commercial Bank and Cheddar Commercial Bank have equity capital to asset ratios of 9% and 7% respectively. i) Estimate the equity multiplier for both banks and critically explain the implications of this ratio to the stakeholders of both banks ( 6 marks) ii) If both institutions have the same Return on Assets ratio of 0.67%, estimate each bank's return to shareholders (4 marks) d) Ozone Commercial Bank wishes to expand into the provision of nontraditional services like investment banking, securities brokerage, and underwriting, and mutual fund sales. Critically discuss the implications of this strategic decision on profitability and the stability of bank earnings. (6 marks) Given this information, is locational arbitrage possible? Show how the corporate treasury could make geographic arbitrage profits with the two different exchange rate quotes if they want to invest E100,000. (9 marks) Question 5 a) Distinguish between a commercial bank's banking book and its trading book. Should there be boundaries between these two books? Explain why or why not. (8 marks) b) Using the following data extract, estimate and explain at least 3 risk indicators for Northern Power Bank Plc (10 marks) c) Ozone Commercial Bank and Cheddar Commercial Bank have equity capital to asset ratios of 9% and 7% respectively. i) Estimate the equity multiplier for both banks and critically explain the implications of this ratio to the stakeholders of both banks ( 6 marks) ii) If both institutions have the same Return on Assets ratio of 0.67%, estimate each bank's return to shareholders (4 marks) d) Ozone Commercial Bank wishes to expand into the provision of nontraditional services like investment banking, securities brokerage, and underwriting, and mutual fund sales. Critically discuss the implications of this strategic decision on profitability and the stability of bank earnings. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts