Question: Given your knowledge about historical returns and basic models of finance, answer the following questions. Assume a safe return of 0%. Explain and clearly

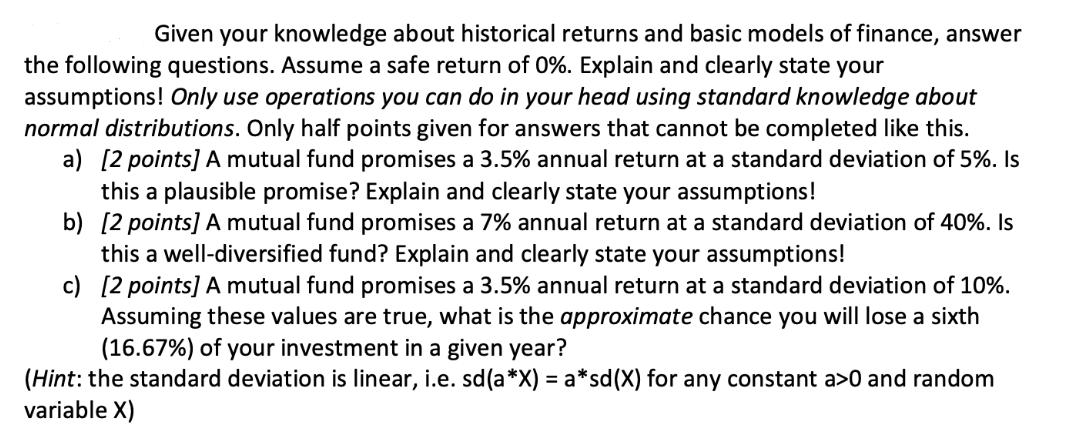

Given your knowledge about historical returns and basic models of finance, answer the following questions. Assume a safe return of 0%. Explain and clearly state your assumptions! Only use operations you can do in your head using standard knowledge about normal distributions. Only half points given for answers that cannot be completed like this. a) [2 points] A mutual fund promises a 3.5% annual return at a standard deviation of 5%. Is this a plausible promise? Explain and clearly state your assumptions! b) [2 points] A mutual fund promises a 7% annual return at a standard deviation of 40%. Is this a well-diversified fund? Explain and clearly state your assumptions! c) [2 points] A mutual fund promises a 3.5% annual return at a standard deviation of 10%. Assuming these values are true, what is the approximate chance you will lose a sixth (16.67%) of your investment in a given year? (Hint: the standard deviation is linear, i.e. sd(a*X) = a*sd(X) for any constant a>0 and random variable X)

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

a A mutual fund promising a 35 annual return at a standard deviation of 5 is a plausible promise Ass... View full answer

Get step-by-step solutions from verified subject matter experts