Question: GKD Ltd . sold $ 7 , 9 6 0 , 0 0 0 of 1 2 % bonds, which were dated March 1 ,

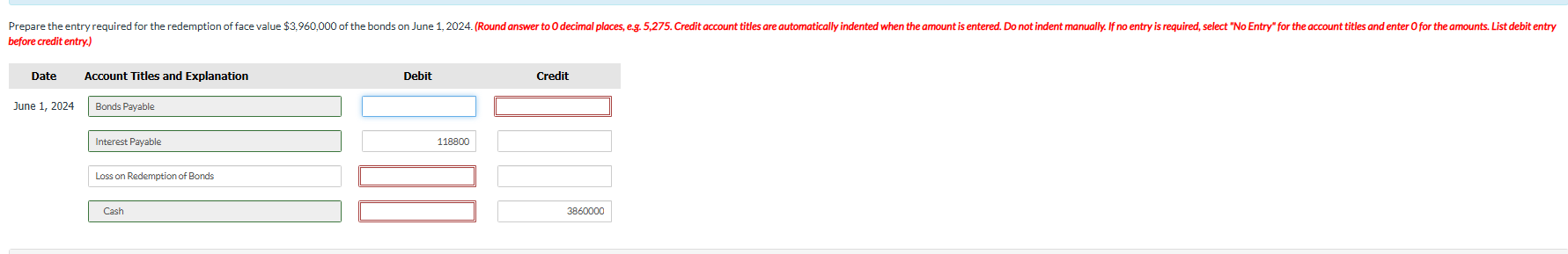

GKD Ltd sold $ of bonds, which were dated March on June The bonds paid interest on September and March of each year. The bonds' maturity date was March and the bonds were issued to yield GKDs fiscal yearend was February and the company followed IFRS. On June GKD bought back $ worth of bonds for $ plus accrued interest. Prepare the journal entry for the accrued interest on the portion of the bonds redeemed. before credit entry. Account Titles and Explanation

Debit

Credit

June

Interest Payable

Loss on Redemption of Bonds

Cash

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock